Disclosure: This post may contain affiliate links, meaning I get a commission if you decide to make a purchase through my links, at no cost to you.

Fusion Markets Review 2026

Best for low-cost forexASIC-regulated broker offering ultra-low spreads from 0.0 pips, $4.50 round-trip commissions, MT4/MT5/cTrader/TradingView support, and fast execution — ideal for scalpers and active forex traders.

- Markets

- Forex, CFDs, Crypto

- Pairs

- 90+

- Platforms

- MT4/MT5/cTrader/TradingView

- Min. deposit

- $0

Risk warning: 74–89% of retail CFD accounts lose money. Consider whether you can afford to take the high risk of losing your money.

Fusion Markets has emerged as a compelling choice for traders seeking ultra-low costs and reliable execution. This Australian-based broker, regulated by ASIC and VFSC, specializes in forex and CFD trading with some of the tightest spreads in the industry. The verdict? Fusion Markets is a legitimate, cost-effective broker ideal for both beginners and experienced traders who prioritize low fees and fast execution. The broker excels in forex trading with over 90 currency pairs and commission rates starting at just $2.25 per side. This comprehensive review examines Fusion Markets' regulatory standing, fee structure, trading platforms, and overall value proposition for 2026. We'll analyze whether their award-winning low-cost model translates into a superior trading experience.

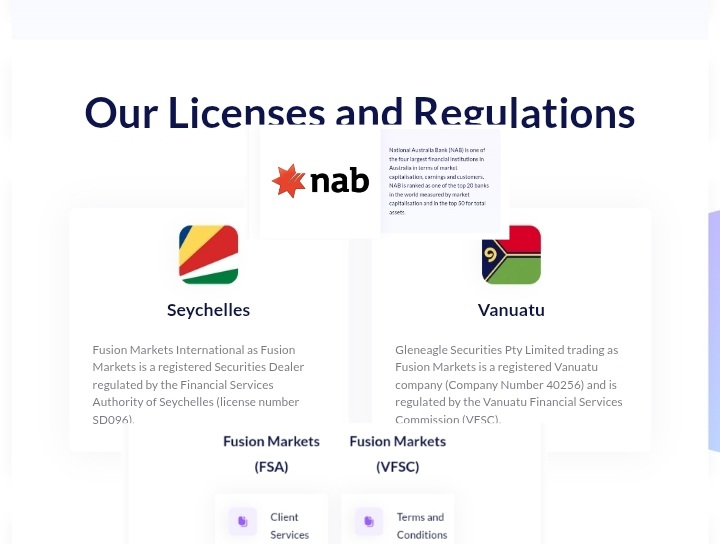

Is Fusion Markets Safe and Legit? Regulation & Trust

Fusion Markets operates under strict regulatory oversight from multiple jurisdictions, establishing it as a legitimate and trustworthy broker. The company maintains licenses from three regulatory bodies, each serving different geographic regions and trader needs. The Australian Securities and Investments Commission (ASIC) provides the broker's primary regulatory framework. ASIC regulation ensures the highest standards of financial conduct and client protection. Under license number 385620, Fusion Markets must maintain segregated client accounts, provide transparent risk disclosures, and adhere to strict capital requirements. The Vanuatu Financial Services Commission (VFSC) regulates the broker's international operations. While not considered top-tier like ASIC, the VFSC license enables Fusion Markets to offer higher leverage ratios up to 1:500 for non-Australian clients. This dual regulatory approach balances strict oversight with flexible trading conditions. A critical risk disclosure: 74-89% of retail CFD accounts lose money when trading. This mandatory warning reflects the inherent risks in leveraged trading. Fusion Markets fulfills its fiduciary duty by prominently displaying this information across its platforms and marketing materials. The broker also holds a license from the Financial Services Authority (FSA) of Seychelles. This additional regulatory coverage expands their global reach while maintaining compliance standards. Each regulatory entity imposes specific requirements for capital adequacy, reporting, and operational procedures. Client funds receive protection through full segregation at National Australia Bank (NAB). Your trading capital remains separate from the broker's operational funds, ensuring protection even in unlikely insolvency scenarios. This segregation represents a fundamental investor protection measure required by ASIC regulations. Trust indicators extend beyond regulatory compliance. Fusion Markets maintains an impressive 4.8-star rating on Trustpilot based on over 4,800 reviews. The overwhelming majority (86%) award five-star ratings, citing excellent customer service and reliable execution as primary strengths.

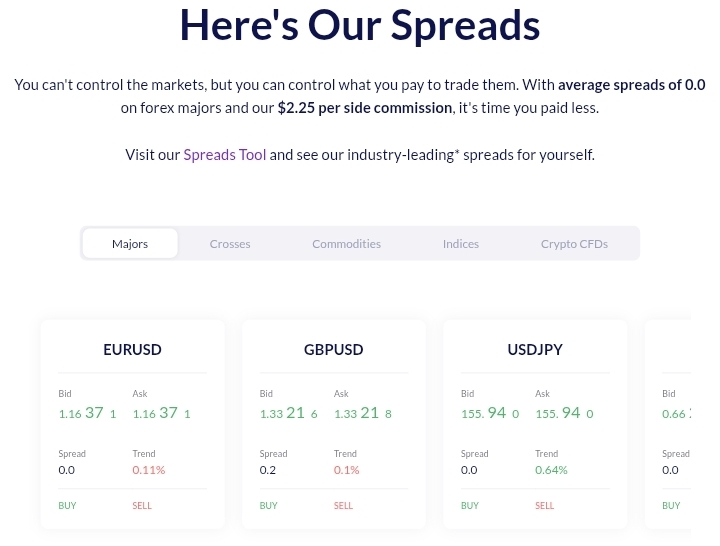

Fees, Spreads, and Costs

Fusion Markets delivers on its promise of ultra-low trading costs through competitive spreads starting from 0.0 pips and minimal commissions. The broker's fee structure ranks among the most competitive in the industry, validated by independent benchmarks from ForexBenchmark and Compareforexbrokers. The Classic account incorporates all costs into the spread with no separate commissions. EUR/USD averages just 1.01 pips, significantly tighter than industry standards. Major pairs like GBP/USD and USD/JPY maintain similarly competitive spreads at 1.14 and 1.17 pips respectively. The ZERO account represents exceptional value for active traders. Raw spreads start from 0.0 pips with a modest $4.50 round-trip commission per standard lot. This translates to just $2.25 per side, substantially lower than the $6-7 charged by most competitors. Let's examine the total cost comparison for trading one standard lot of EUR/USD: Classic Account costs total $20.20 per round trip based on the 1.01 pip average spread. The calculation assumes entry and exit at the same price level for comparison purposes. ZERO Account costs just $6.52 per round trip. This includes the 0.11 pip average spread ($2.20) plus the $4.50 commission. Active traders save over 65% on trading costs by choosing the ZERO account. Non-trading fees remain refreshingly absent. Fusion Markets charges zero fees for deposits, withdrawals, or account inactivity. This no-fee policy extends to all supported payment methods, though international bank transfers may incur charges from intermediary banks. The broker maintains transparency in overnight financing charges. Swap rates reflect interbank tom-next rates without additional markup. Traders can earn positive swaps when holding positions in higher-yielding currencies against lower-yielding ones. No minimum deposit requirements remove barriers for new traders. Whether funding with $50 or $50,000, all clients access the same competitive pricing and conditions. This democratization of low-cost trading distinguishes Fusion Markets from brokers imposing high minimums for preferential rates. Currency conversion fees apply only when depositing or withdrawing in currencies different from your account base. The broker supports 14 base currencies, minimizing conversion needs for international clients.

Trading Platforms & Tools

Fusion Markets provides an exceptional selection of trading platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView integration. This diverse platform offering caters to traders with varying experience levels and technical requirements. MetaTrader 4 remains the industry standard for forex trading. The platform delivers robust charting capabilities, automated trading through Expert Advisors, and seamless mobile integration. Over 30 technical indicators and multiple timeframes enable comprehensive market analysis. The familiar interface reduces the learning curve for traders migrating from other brokers. MetaTrader 5 expands capabilities with 21 timeframes, 38 technical indicators, and access to additional asset classes. The multi-asset platform supports stock CFDs alongside traditional forex and commodity instruments. Enhanced order types and superior backtesting capabilities appeal to systematic traders. cTrader stands out for ECN-focused trading with Level II market depth and advanced order management. The platform's modern interface provides one-click trading, detachable charts, and sophisticated risk management tools. Algorithmic traders benefit from cTrader Automate supporting C# programming for custom indicators and automated strategies. TradingView integration brings professional-grade charting to Fusion Markets clients. The platform's social features enable idea sharing while maintaining institutional-quality analysis tools. Cloud-based functionality ensures chart layouts and analysis sync across all devices. Copy trading expands passive income opportunities through multiple services. DupliTrade allows automatic replication of successful trader strategies directly into MT4 accounts. The proprietary Fusion+ platform connects signal providers with followers, creating a marketplace for trading strategies. Myfxbook AutoTrade provides additional social trading options with transparent performance tracking. Traders can evaluate historical results before committing capital to any strategy. The integration maintains full compatibility with Fusion Markets' low-cost structure. Mobile trading receives full support across all platforms. Native iOS and Android applications deliver desktop-equivalent functionality for on-the-go trading. Push notifications keep traders informed of market movements and account activity. Virtual Private Server (VPS) hosting enhances execution speed for automated strategies. Average execution times of 70-80 milliseconds place Fusion Markets among the fastest brokers globally. The low-latency infrastructure particularly benefits high-frequency trading strategies.

Fusion Markets and Others-- Compare

| Broker | Overall Score | Trading Platforms | Spreads & Pricing | Regulation | Best For | |

|---|---|---|---|---|---|---|

|

Fusion Markets

Low-cost ASIC-regulated broker

|

★★★★☆ | MT4, MT5, cTrader | Ultra-low spreads • Low commission | ASIC, VFSC | Lowest-cost trading, algorithmic traders | Visit Site |

|

IG

Global FTSE-250 multi-asset broker

|

★★★★★ | IG Platform, MT4, L2 Dealer | Competitive spreads • No hidden fees | FCA, ASIC, NFA/CFTC, MAS | Professional research, advanced tools | Learn More |

|

Forex.com

Well-established US & global broker

|

★★★★☆ | MT4, MT5, Forex.com App | Tight spreads • Choice of pricing models | CFTC, NFA, FCA, ASIC | US traders, multi-asset trading | Learn More |

|

Oanda

Trusted for transparency and accurate pricing

|

★★★★☆ | Oanda Trader, MT4, MT5 (regions) | Fair pricing • No markup gimmicks | CFTC, NFA, FCA, MAS | Casual traders & long-term investors | Learn More |

|

Pepperstone

Fast execution & advanced platforms

|

★★★★★ | MT4, MT5, cTrader, TradingView | RAW spreads • Institutional-grade execution | ASIC, FCA, CySEC, DFSA | Scalping, automation, pro-level tools | Learn More |

Trading CFDs involves significant risk. Between 70%–90% of retail investor accounts lose money when trading CFDs. Always consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Account Types & Products

Fusion Markets offers two primary account types designed to accommodate different trading styles and experience levels. The Classic and ZERO accounts provide transparent pricing models without hidden fees or complex tier structures. The Classic account suits beginners through its straightforward all-inclusive spread model. No commission calculations simplify position sizing and risk management for new traders. The 0.9 pip markup added to raw spreads remains highly competitive compared to standard accounts at other brokers. ZERO accounts deliver institutional-grade pricing for serious traders. Raw ECN spreads combined with low commissions create optimal conditions for scalping and high-frequency strategies. The $4.50 round-trip commission represents exceptional value in the retail forex space. Professional traders meeting specific criteria can access Fusion Markets Pro accounts. Benefits include leverage up to 1:500 on forex and metals, priority support, and volume-based rebates. Eligibility requires either AU$2.5 million in net assets or substantial trading experience. The product range emphasizes forex with over 90 currency pairs available. Major pairs offer maximum liquidity and tightest spreads. Minor and exotic pairs expand opportunities for traders seeking volatility or carry trade strategies. Leverage options vary by jurisdiction and account type. Australian clients face ASIC-mandated limits of 1:30 for forex and 1:20 for indices. International clients access up to 1:500 leverage, enabling smaller accounts to take meaningful positions. Commodity CFDs cover precious metals, energies, and agricultural products. Gold and silver trade against USD, EUR, and AUD, providing currency hedging flexibility. Energy traders access both Brent and WTI crude oil contracts alongside natural gas. Stock CFDs focus exclusively on US equities with over 110 major companies available. While the selection appears limited compared to specialized stock brokers, it covers essential blue-chip names for portfolio diversification. Cryptocurrency CFDs include 13 major digital assets from Bitcoin to emerging altcoins. The crypto offering enables speculation without the complexity of wallet management or exchange security concerns. Index CFDs span 15 global benchmarks including S&P 500, FTSE 100, and DAX 40. The selection covers major economies but lacks the depth offered by larger multi-asset brokers. Regional indices and sector-specific benchmarks remain notably absent. Islamic accounts accommodate traders requiring swap-free conditions. These accounts maintain the same competitive spreads and commissions while eliminating overnight interest charges incompatible with Sharia law.

Customer Support & User Experience

Fusion Markets delivers exceptional customer support through multiple channels with 24/7 availability. The broker's commitment to "White Glove Support" translates into personalized assistance that exceeds industry standards. Live chat provides near-instantaneous responses to queries. Support agents demonstrate deep product knowledge and genuine enthusiasm for helping clients succeed. The chat interface remains accessible throughout the website, ensuring help is always one click away. Phone support maintains the same high standards with minimal wait times. The international phone number (+61 3 8376 2706) connects traders directly to knowledgeable representatives. Email inquiries receive detailed responses typically within hours rather than days. The account opening process exemplifies user-friendly design. Registration takes under 10 minutes with verification often completed within one hour. The streamlined KYC process requires only essential documentation: proof of identity and address verification. Notably absent is the typical suitability assessment questionnaire. While this expedites account opening, it raises questions about client qualification procedures. The lack of experience verification may concern traders who value comprehensive broker due diligence. The client portal provides intuitive navigation to all essential functions. Account management, platform downloads, and support resources remain easily accessible. The interface works seamlessly across desktop and mobile devices. Dedicated account managers serve Fusion Markets Pro clients with personalized guidance. These specialists provide market insights, platform training, and strategic consultation based on individual trading goals. The FAQ section comprehensively addresses common concerns across account management, trading conditions, and technical issues. Well-organized categories and search functionality minimize the need for direct support contact. Platform specialists offer specialized assistance for MT4/MT5 technical challenges. This targeted support proves invaluable for traders encountering platform-specific issues or seeking to optimize their setup. Response quality consistently impresses across all support channels. Representatives avoid scripted responses in favor of thoughtful, tailored solutions. The Australian-based support team operates during extended hours to serve global clients effectively.

Fusion Markets — Pros & Cons

Pros

- Ultra-low trading costs — ZERO account with raw spreads from 0.0 pips + $4.50 round-trip commission ($2.25 per side).

- Transparent pricing — Clear Classic vs ZERO pricing models and no hidden non-trading fees (deposits/withdrawals/inactivity).

- Strong regulation (primary) — ASIC oversight for Australian clients and segregated client funds at NAB.

- Multiple professional platforms — MT4, MT5, cTrader and TradingView integration suit discretionary and algo traders.

- Low-latency execution — Average execution ~70–80ms and optional VPS for EAs and automated strategies.

- No minimum deposit — Easy entry for new traders; same pricing regardless of deposit size.

Cons

- Limited stock CFDs — Primarily US equities; lacks broad European & Asian stock coverage for some traders.

- Education resources — Fewer structured educational materials compared with major multi-asset brokers.

- Leverage restrictions by jurisdiction — ASIC clients face conservative limits (e.g., 1:30 for forex) versus up to 1:500 for international clients.

- Negative balance protection — May be available for Australian clients but not guaranteed for all international jurisdictions.

- Suitability checks — Account opening is fast but lacks a detailed suitability questionnaire some traders expect.

Short takeaway: Fusion Markets is best for cost-conscious forex traders (scalpers/day traders) who prioritise tight spreads and fast execution. Traders needing broad stock coverage or comprehensive learning resources may prefer larger multi-asset brokers.

Conclusion & Final Recommendation

Fusion Markets stands out as an exceptional choice for cost-conscious traders seeking reliable execution and regulatory protection. The broker successfully combines ultra-competitive pricing with robust infrastructure and responsive customer support. The strengths are compelling. Industry-leading spreads from 0.0 pips and $4.50 round-trip commissions create unmatched value for active traders. ASIC regulation provides peace of mind while segregated accounts protect client funds. The selection of four major trading platforms accommodates diverse trading styles and strategies. ECN execution ensures transparent pricing without dealing desk intervention. The 90+ forex pairs represent one of the most comprehensive offerings available to retail traders. Zero non-trading fees further enhance the cost advantage, particularly for smaller accounts. Weaknesses require consideration but don't overshadow the positives. Limited educational resources may frustrate complete beginners seeking structured learning paths. The absence of European and Asian stock CFDs restricts equity traders. International clients lack the negative balance protection afforded to Australian residents. For forex-focused traders prioritizing low costs and reliable execution, Fusion Markets represents an outstanding choice. The broker particularly suits experienced traders who value transparent pricing over educational hand-holding. Scalpers and day traders will appreciate the tight spreads and fast execution speeds. Beginners can still succeed with Fusion Markets given the intuitive platforms and helpful support. However, those requiring extensive educational resources might initially supplement with external learning materials. The zero minimum deposit allows testing the waters without significant capital commitment. The 2026 outlook remains highly positive as Fusion Markets continues expanding its global footprint. Additional regulatory licenses and expanded asset coverage would address current limitations. The broker's commitment to maintaining ultra-low costs while improving services positions it well for continued growth. Our recommendation: Fusion Markets earns strong endorsement for forex and CFD traders seeking professional trading conditions without institutional minimums. The combination of regulatory security, competitive pricing, and quality execution creates compelling value that few brokers match.