Etoro is a leading social trading and multi-asset investment platform that has revolutionized the way people engage in financial markets.

With a user-friendly interface and innovative features, Etoro enables both novice and experienced traders to access a wide range of investment opportunities, including stocks, cryptocurrencies, commodities, and more.

The platform’s unique offering of social trading allows users to connect, interact, and even replicate the trading strategies of successful traders, making investing a collaborative and educational experience.

This article delves into the various aspects of Etoro, providing insights into its history, key features, trading tools, supported assets, and the advantages and disadvantages of using this platform.

What is Etoro?

Etoro is a leading social trading and investment platform that allows people from all over the world to trade and invest in various financial markets.

It brings together the power of technology and the wisdom of the crowd, creating a unique and innovative approach to online trading.

Etoro’s Mission and Vision

Etoro’s mission is to democratize traditional financial markets and make them accessible to everyone.

They believe that knowledge and information should be shared, and that anyone, regardless of their background or financial expertise, should have the opportunity to participate in global markets.

Etoro envisions a world where people can connect, collaborate, and trade with confidence, ultimately empowering individuals to take control of their financial future.

History and Background of Etoro

Etoro was founded in 2007 by brothers Ronen and Yoni Assia, along with David Ring. The company’s original vision was to create an online trading platform that would be both user-friendly and accessible to traders of all experience levels.

With this goal in mind, they launched Etoro, introducing innovative features and tools that would later revolutionize the online trading industry.

Etoro’s Growth and Expansion

Over the years, Etoro has experienced significant growth and expansion. The platform quickly gained popularity, attracting millions of users from around the globe. In 2010, Etoro introduced the concept of social trading, allowing users to connect with and copy the trades of successful traders.

This unique feature propelled Etoro to new heights, solidifying its position as a pioneer in the industry. Today, Etoro continues to grow and evolve, constantly innovating and expanding its offerings to meet the needs of its ever-growing user base.

Key Features and Services Offered by Etoro

Etoro’s Trading Platform

Etoro’s trading platform is user-friendly, intuitive, and packed with powerful tools and features.

Whether you’re a beginner or an experienced trader, you’ll find everything you need to analyze markets, execute trades, and manage your portfolio efficiently.

The platform offers real-time charting, advanced technical analysis indicators, and a wide range of order types to suit your trading style.

Etoro’s Investment Products

Etoro provides access to a diverse array of investment products, including stocks, cryptocurrencies, commodities, currencies, and more.

Whether you’re interested in investing in popular tech stocks like Apple and Amazon, or exploring the potential of cryptocurrencies like Bitcoin and Ethereum, Etoro has you covered.

Etoro’s Social Trading Network

One of Etoro’s standout features is its social trading network. This unique concept allows users to connect with other traders, discuss investment ideas, and even automatically copy the trades of successful investors.

By leveraging the collective wisdom of the Etoro community, you can learn from experienced traders and potentially improve your own trading results.

How to Get Started with Etoro

Creating an Etoro Account

To get started with Etoro, you’ll need to create an account. Simply visit the Etoro website and click on the ‘Sign Up’ button.

You can choose to sign up using your email address or social media accounts for a quicker process. Fill in the required information and agree to the terms and conditions to complete the registration.

Verifying Your Account

After creating your account, you’ll need to verify your identity. This is a standard procedure to ensure the safety and security of your account. Simply follow the instructions provided by Etoro to upload the necessary documents, such as a valid ID or proof of address. Once your account is verified, you’ll be able to access all the features and services offered by Etoro.

Depositing Funds into Your Account

To start trading or investing on Etoro, you’ll need to deposit funds into your account. Etoro provides various payment methods, including bank transfers, credit cards, and e-wallets, making it convenient for users around the world.

Simply navigate to the ‘Deposit Funds’ section on the platform, choose your preferred payment method, and follow the instructions to complete the deposit. Once the funds are credited to your account, you can begin your trading journey with Etoro.

Buying Bitcoin on eToro

Buying Bitcoin on eToro is a straightforward process and only takes a few simple steps. Take this steps to but bitcoin and ethereum.

1. Create an Account (if you haven’t already):

- Head to eToro’s website or download the app.

- Click “Sign Up” and fill in your basic information.

- Verify your account through the provided instructions.

2. Fund Your Account:

- Click “Deposit Funds” and choose your preferred payment method. eToro supports various options like debit/credit cards, bank transfers, e-wallets, etc.

- Enter the desired deposit amount and complete the payment process.

3. Buy Bitcoin:

- Navigate to the Bitcoin page on eToro. You can search for it in the search bar.

- Click “Open Trade” or “Invest.”

- Choose “Trade” for an instant purchase at the current market price or “Order” to set a specific price at which you want to buy Bitcoin.

- Enter the amount of Bitcoin you want to buy (you can buy fractions of Bitcoin) or the desired investment amount.

- Review the order details and click “Open Trade” or “Set Order” to confirm.

4. Your Bitcoin Purchase:

- Your purchased Bitcoin will be reflected in your eToro portfolio.

- You can hold it, trade it for other cryptocurrencies, or withdraw it to your external wallet (supported for some countries).

Additional Tips:

- Consider setting stop-loss orders to limit potential losses in case of price fluctuations.

- eToro offers educational resources and market analysis tools to help you make informed investment decisions.

- Start with a small amount of money if you’re new to cryptocurrency investing.

Etoro’s Trading Platform and Tools

Charting and Technical Analysis Tools

Etoro equips traders with a range of charting and technical analysis tools to aid in making informed trading decisions.

The platform provides various chart types, indicators, and drawing tools, allowing you to analyze market trends and patterns. Whether you’re a novice or a seasoned trader, Etoro’s charting and technical analysis tools can help you identify potential entry and exit points.

Risk Management Features

Etoro understands the importance of risk management in trading. The platform offers several risk management features to help you protect your investments.

These include stop-loss orders, take-profit orders, and trailing stops. With these tools, you can set predefined price levels to limit potential losses and secure profits when the market moves in your favor.

Here’s a table showing eToro’s account types, along with their key features and requirements:

| Feature | Retail Account | Professional Account |

|---|---|---|

| Minimum Deposit | $50 | $20,000 |

| Leverage | Up to 1:30 for retail clients (EU), up to 1:400 for professional clients | Up to 1:400 |

| Fees | Spreads, overnight fees, inactivity fee after 12 months | Spreads, overnight fees |

| Investor Protection | Investor Compensation Fund (ICF) | No ICF protection |

| Negative Balance Protection | Yes | No |

| Stop Loss and Take Profit Orders | Yes | Yes |

| Copy Trading | Yes | Yes |

| Access to All Assets | Yes | Yes |

| Eligibility | General retail investors | Experienced traders who meet specific criteria |

Key Differences:

- Leverage: Professional accounts offer higher leverage, which can amplify both potential profits and losses.

- Investor Protection: Retail accounts benefit from the ICF, which compensates investors in case of broker insolvency. Professional accounts do not have this protection.

- Negative Balance Protection: Retail accounts have negative balance protection, ensuring losses cannot exceed deposited funds. Professional accounts do not have this safeguard.

- Eligibility: Professional accounts require meeting specific criteria, including trading experience, financial knowledge, and risk tolerance.

Choosing the Right Account:

- Retail accounts are generally well-suited for most individual investors. They offer protection mechanisms and are designed for those who prioritize safety and don’t require high leverage.

- Professional accounts are intended for experienced traders who fully understand the risks involved and can manage high leverage. They offer greater flexibility but come with less protection.

It’s crucial to carefully consider your trading experience, risk tolerance, and financial goals before choosing an account type.

Social Trading and Copy Trading on Etoro

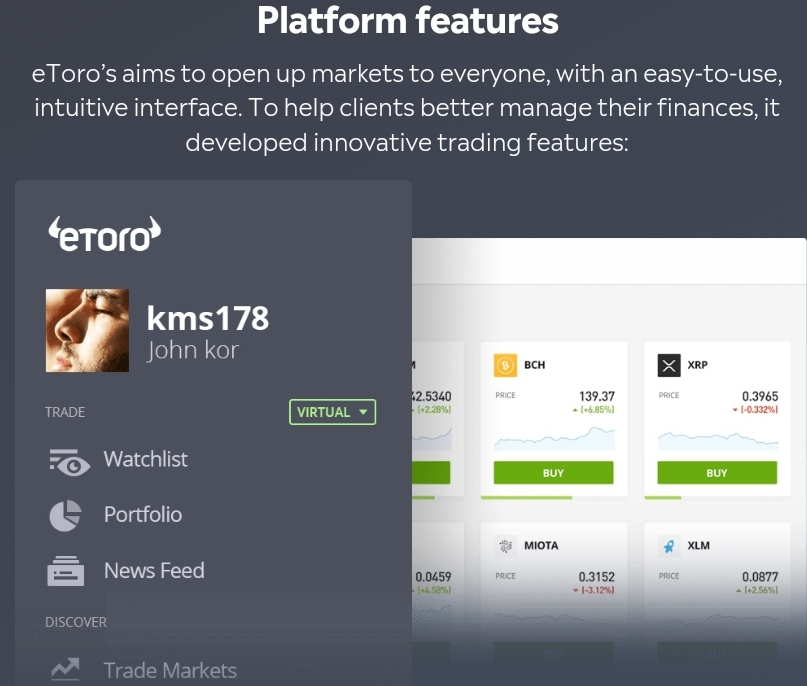

Understanding Social Trading

Social trading is like having a community of traders at your fingertips. Etoro’s social trading feature allows users to connect, interact, and learn from fellow traders.

You can follow and interact with successful traders, view their portfolios, and even copy their trades. This creates a unique social trading environment where you can leverage the knowledge and expertise of others to improve your trading strategies.

How Copy Trading Works on Etoro

Etoro’s copy trading feature takes social trading to the next level. With a simple click of a button, you can automatically replicate the trades of top-performing traders on the platform.

This means that even if you have limited knowledge or experience in trading, you can still potentially benefit from the success of expert traders. Etoro’s copy trading feature is an excellent tool for beginners looking to learn from the best in the industry.

Maximizing Benefits from Social Trading

To make the most of Etoro’s social trading features, it’s essential to do your research and choose traders to follow or copy carefully. Look for traders with a consistent track record and a trading strategy that aligns with your goals and risk tolerance.

Additionally, engage with the trading community, ask questions, and learn from others. Social trading on Etoro can be a valuable learning experience and a way to potentially improve your trading results.

Buying Tesla stock on eToro

Buying Tesla stock on eToro is a quick and easy process, and here’s a step-by-step guide to help you:

1. Access your eToro account:

- If you haven’t already, create an account on eToro and verify it.

2. Search for Tesla Stock:

- Open the eToro platform and use the search bar to find “Tesla” or “TSLA.” Alternatively, you can browse through the “Stocks” section.

3. Open a Trade:

- Once you find Tesla stock, click on “Open Trade” or “Invest.”

4. Choose your Trade Type:

- Trade: This option allows you to instantly purchase Tesla stock at the current market price.

- Order: This option lets you set a specific price at which you want to buy Tesla stock. This way, you can wait for the price to drop before making your purchase.

5. Enter Trade Details:

- Decide how much you want to invest in Tesla stock. You can either enter a specific dollar amount or choose the number of shares you want to buy (Tesla fractional shares are available on eToro).

- Review the order details, including the total cost, estimated fees, and potential profit/loss based on current market conditions.

6. Confirm the Trade:

- Click “Open Trade” (for instant purchase) or “Set Order” (for specific price purchase) to confirm your decision.

7. Track your Tesla Stock:

- Your purchased Tesla stock will be reflected in your eToro portfolio. You can monitor its performance, buy more shares, sell your existing shares, or set stop-loss orders to manage your risk.

Etoro’s Supported Assets and Investment Opportunities

Trading Stocks and ETFs on Etoro

Etoro offers a wide range of investment opportunities, including trading stocks and ETFs. With Etoro, you can trade popular stocks from leading global exchanges, giving you exposure to companies you believe in.

Additionally, you can diversify your portfolio by investing in ETFs, which provide access to a basket of different assets, such as stocks, bonds, or commodities.

Investing in Cryptocurrencies on Etoro

Cryptocurrencies have gained significant popularity in recent years, and Etoro allows you to easily invest in these digital assets. You can trade and invest in a variety of cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, among others. Etoro’s cryptocurrency offerings provide traders and investors with opportunities in this exciting and rapidly evolving market.

Exploring Other Asset Classes on Etoro

In addition to stocks, ETFs, and cryptocurrencies, Etoro provides access to other asset classes. These include commodities like gold and oil, forex currency pairs, and indices representing different markets globally.

Etoro’s diverse range of investment choices allows you to create a well-rounded portfolio tailored to your investment goals and preferences.

The Pros and Cons of Using Etoro

Advantages of Etoro

Etoro offers several advantages that make it an attractive choice for many traders. The user-friendly platform, social trading features, and a wide range of investment options provide a comprehensive trading experience.

The ability to copy trades from successful traders makes it suitable for beginners, while advanced traders can take advantage of the charting and technical analysis tools. Etoro’s commitment to investor education and regulation adds another layer of trust. Compare platform with binance.

Potential Drawbacks of Etoro

While Etoro has many benefits, there are a few potential drawbacks to consider. Etoro’s fee structure may be higher compared to some other online brokers. Additionally, certain investment options, such as fractional shares, may not be available for all assets.

It’s essential to carefully review the fees and available features to ensure they align with your trading needs and preferences before using Etoro.In conclusion, Etoro has emerged as a prominent player in the world of online trading and investment.

With its user-friendly platform, extensive range of supported assets, and innovative social trading features, Etoro has successfully democratized investing, making it accessible to individuals from all walks of life.

Whether you are a beginner looking to learn from experienced traders or a seasoned investor seeking diverse investment opportunities, Etoro offers a comprehensive solution. While it is important to weigh the pros and cons, Etoro undoubtedly provides a unique and valuable platform for individuals interested in engaging with financial markets.

FAQ

1. Is Etoro a regulated platform?

Etoro is a regulated platform and operates under the oversight of various financial authorities, depending on the jurisdiction. It is licensed and regulated by reputable organizations such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). This regulatory framework ensures that Etoro adheres to strict standards and guidelines to protect the interests of its users.

2. Can I trade on Etoro with a small investment?

Yes, Etoro offers the flexibility to start trading with a small investment. The platform allows users to trade fractional shares, meaning you can invest in fractions of a stock or asset, making it more accessible for individuals with limited capital. Additionally, Etoro offers low minimum deposit requirements, allowing you to start investing with an amount that suits your budget.

3. How does the social trading feature work on Etoro?

Etoro’s social trading feature allows users to connect with other traders, see their trading activities in real-time, and even copy their trades automatically.

By following successful traders and replicating their strategies, users can learn from experienced investors and potentially improve their own trading performance. It is important to conduct thorough research and carefully consider the risk associated with copying trades, as past performance is not indicative of future results.

4. Can I use Etoro on my mobile device?

Yes, Etoro offers a mobile application that is available for both iOS and Android devices. The mobile app allows users to trade, manage their portfolios, and access the social trading network on the go.

The intuitive and user-friendly interface ensures a seamless and convenient trading experience, providing flexibility for users to monitor and execute trades from anywhere at any time.