Forex.com: Complete Broker Breakdown for Beginners & Experts

Forex.com stands as one of the most recognizable names in online trading. With over two decades of market presence, this broker has built a reputation that attracts both newcomers and seasoned professionals. But does the reality match the reputation?

This comprehensive Forex.com review dives deep into what makes this broker tick. We’ll examine everything from regulatory compliance to trading costs. Whether you’re considering your first trade or looking to switch brokers, this analysis provides the insights you need.

The forex market moves $7.5 trillion daily, and choosing the right broker can make or break your trading journey. Let’s discover if Forex.com deserves a spot on your shortlist.

What is Forex.com?

Forex.com operates as a global forex and CFD broker serving millions of traders worldwide. Founded in 1999, the company pioneered online currency trading for retail investors. Today, it maintains offices across North America, Europe, Asia, and Australia.

Forex.com operates as a global forex and CFD broker serving millions of traders worldwide. Founded in 1999, the company pioneered online currency trading for retail investors. Today, it maintains offices across North America, Europe, Asia, and Australia.

The broker’s parent company, StoneX Group Inc., trades on NASDAQ under the ticker symbol SNEX. This public listing adds an extra layer of transparency and accountability. With over $100 billion in client assets, Forex.com ranks among the industry’s largest players.

Traders choose Forex.com for its regulatory compliance and market access. The platform offers over 80 currency pairs alongside commodities, indices, and cryptocurrencies. Some traders avoid it due to regional restrictions and varying fee structures across different account types.

Is Forex.com Legit and Safe?

Regulatory oversight forms the backbone of any legitimate broker, and Forex.com excels here. The company holds licenses from top-tier financial authorities worldwide. Each regional office operates under strict regulatory frameworks designed to protect traders.

Key regulatory bodies overseeing Forex.com include:

- CFTC (Commodity Futures Trading Commission) – Regulates US operations with strict capital requirements

- NFA (National Futures Association) – Enforces compliance standards for US forex brokers

- FCA (Financial Conduct Authority) – Supervises UK and European operations with comprehensive investor protections

- ASIC (Australian Securities and Investments Commission) – Oversees Australian operations with robust regulatory standards

- IIROC (Investment Industry Regulatory Organization) – Monitors Canadian operations ensuring fair trading practices

Client funds receive protection through segregated accounts at major banks. This separation ensures your money remains distinct from the broker’s operational funds. In the unlikely event of company insolvency, your deposits stay protected.

Negative balance protection shields traders from owing more than their account balance. This crucial feature prevents devastating losses during extreme market volatility. However, availability varies by region due to different regulatory requirements.

Forex.com At a Glance

Here’s a quick snapshot of what Forex.com offers:

| Regulation | CFTC, NFA, FCA, ASIC, IIROC |

| Minimum Deposit | $100 (varies by region) |

| Account Types | Standard, Commission, STP Pro |

| Trading Assets | 80+ forex pairs, indices, commodities, cryptos |

| Platforms | MT4, MT5, Proprietary platform, Mobile apps |

| Leverage | Up to 1:50 (US), 1:30 (EU), 1:400 (other regions) |

| Spread Type | Variable spreads from 0.0 pips |

If you’re comparing brokers, visit our main guide:

Best Forex Brokers 2026 – Top 10 List

Forex.com Account Types

Choosing the right account type significantly impacts your trading experience and costs. Forex.com offers multiple account options tailored to different trading styles and experience levels. Each account comes with unique features and pricing structures.

Standard Account

The Standard Account serves as the entry point for most traders. No commissions apply, making cost calculations straightforward. Spreads start from 1.0 pip on major pairs like EUR/USD. This account suits beginners who prefer transparent, all-inclusive pricing.

Minimum deposit requirements remain accessible at $100 in most regions. The account includes full platform access and educational resources. Traders can use all available instruments without restrictions.

Commission Account

Professional traders often prefer the Commission Account for its tighter spreads. Raw spreads start from 0.0 pips with a commission of $5 per standard lot. This structure benefits high-volume traders who prioritize minimal spread costs.

The transparent commission model allows precise cost calculations for algorithmic strategies. Active traders save significantly compared to spread-only accounts. However, beginners might find the dual pricing structure confusing initially.

STP Pro Account

The STP Pro Account targets institutional traders and high-net-worth individuals. Direct market access ensures lightning-fast execution speeds. Spreads and commissions vary based on trading volume and negotiated rates.

This account type requires higher minimum deposits, typically $10,000 or more. Professional traders gain access to premium features like dedicated account managers. Enhanced liquidity and priority support justify the higher entry barrier.

Islamic Accounts

Forex.com provides swap-free Islamic accounts complying with Sharia law. These accounts eliminate overnight interest charges on positions. Muslim traders can access all standard features while maintaining religious compliance.

Forex.com Trading Instruments Available

Market diversity allows traders to build balanced portfolios and exploit various opportunities. Forex.com offers an extensive range of tradeable instruments across multiple asset classes. This variety enables sophisticated trading strategies and risk management.

Forex Currency Pairs

The platform features over 80 currency pairs spanning majors, minors, and exotics. Popular pairs like EUR/USD, GBP/USD, and USD/JPY enjoy tight spreads and deep liquidity. Major pairs typically see spreads starting from 0.8 pips during peak trading hours.

Rich pairs provide opportunities in emerging markets but carry wider spreads. Traders can access currencies from developed and developing economies worldwide. The selection rivals most top-tier brokers in the industry.

Indices and Commodities

Global stock indices offer exposure to entire economies through single trades. Forex.com provides CFDs on major indices including S&P 500, FTSE 100, and DAX 30. These instruments allow speculation on broader market movements without picking individual stocks.

Commodity trading covers precious metals, energy products, and agricultural goods. Gold and silver remain popular choices for portfolio diversification. Oil traders can choose between WTI and Brent crude contracts.

Cryptocurrencies

Digital asset trading continues growing in popularity among retail traders. Forex.com offers cryptocurrency CFDs including Bitcoin, Ethereum, and other major coins. These instruments provide crypto exposure without wallet management complexities.

Crypto CFDs feature 24/7 trading, unlike traditional forex markets. Leverage restrictions apply due to extreme volatility in digital assets. Spreads remain competitive compared to dedicated crypto exchanges.

Forex.com Trading Platforms

Platform selection dramatically influences your trading efficiency and success potential. Forex.com provides multiple platform options catering to different preferences and skill levels. Each platform offers unique advantages for specific trading styles.

MetaTrader 4 & 5

The industry-standard MetaTrader platforms remain available in most regions. MT4 continues dominating retail forex trading with its extensive indicator library. Thousands of custom indicators and expert advisors enhance trading capabilities.

MT5 adds multi-asset capabilities and improved backtesting features. Both platforms support automated trading through Expert Advisors (EAs). The familiar interface reduces learning curves for traders switching brokers.

Proprietary Trading Platform

Forex.com’s proprietary platform showcases modern design with powerful functionality. Advanced charting includes over 50 technical indicators and drawing tools. The platform integrates seamlessly with research tools and market analysis.

One-click trading speeds up order execution for scalpers and day traders. Customizable layouts allow traders to create personalized workspaces. The platform runs smoothly on various devices without performance issues.

Mobile Trading Features

Mobile apps deliver full trading functionality for iOS and Android devices. The apps mirror desktop features including advanced charting and order management. Push notifications keep traders informed about market movements and account activity.

Touch-optimized interfaces make mobile trading intuitive and efficient. Biometric security adds extra account protection on supported devices. Mobile traders can manage positions anywhere with internet connectivity.

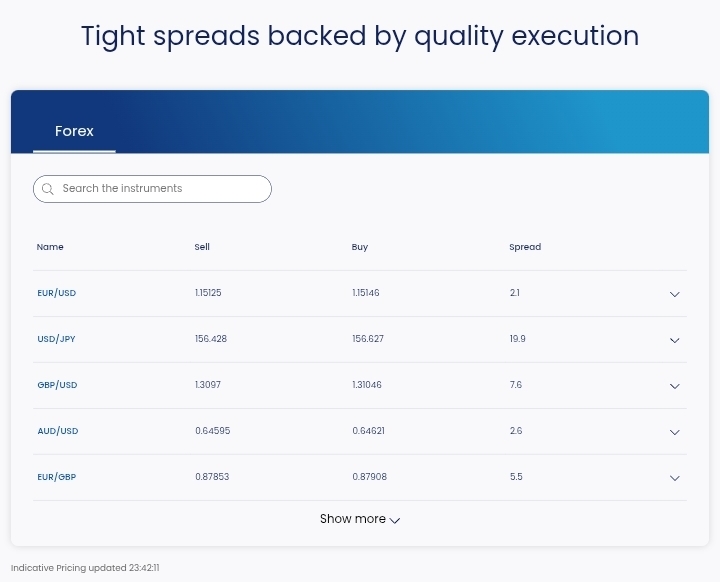

Forex.com Fees, Spreads & Commissions

Understanding trading costs helps maximize profitability and avoid surprises. Forex.com maintains competitive pricing across different account types and instruments. Transparent fee structures allow accurate cost calculations before placing trades.

Spread Analysis

Major currency pairs enjoy some of the tightest spreads in the industry. EUR/USD spreads start from 0.8 pips on standard accounts during peak hours. GBP/USD typically sees spreads from 1.2 pips, while USD/JPY starts around 1.0 pip.

Rich pairs naturally carry wider spreads due to lower liquidity. USD/TRY might see spreads exceeding 20 pips during volatile periods. Gold (XAU/USD) spreads average 3.0 pips but tighten during active trading sessions.

Commission Structure

Commission accounts charge $5 per standard lot roundtrip but offer raw spreads. This model benefits high-volume traders who prioritize minimal spread costs. The transparent commission structure simplifies cost calculations for algorithmic strategies.

Standard accounts include all costs within the spread, eliminating separate commissions. This all-inclusive pricing appeals to beginners and casual traders. However, active traders often save money with commission-based accounts.

Additional Fees

Overnight financing charges apply to positions held past market close. Swap rates vary by currency pair and current interest rate differentials. Islamic accounts eliminate these charges for Sharia-compliant trading.

Inactivity fees of $15 monthly apply after 12 months without trading. Deposit and withdrawal fees depend on payment methods and regions. Bank wire transfers might incur charges while e-wallets often process free. Compare platform with Oanda broker.

Final Verdict:

Forex.com emerges as a solid choice for traders prioritizing safety and reliability. Strong regulatory oversight across multiple jurisdictions provides peace of mind. The broker’s long history and public company status add credibility.

Beginners benefit from comprehensive educational resources and intuitive platforms. Professional traders appreciate tight spreads and advanced trading tools. The variety of account types accommodates different trading styles and experience levels.

However, regional restrictions limit availability in some countries. Traders in restricted regions must seek alternatives. Additionally, some rich pairs carry wider spreads compared to specialized brokers.

For most traders, Forex.com offers an excellent balance of features, costs, and security. The combination of regulatory compliance, competitive pricing, and platform variety creates a compelling package. Whether you’re starting your trading journey or seeking a reliable broker for long-term success, Forex.com deserves serious consideration.

The broker particularly excels for traders who value regulatory protection above rock-bottom costs. While some competitors offer tighter spreads, few match Forex.com’s regulatory credentials. This makes it an ideal choice for risk-conscious traders building long-term wealth through forex trading. Start trading with forex.com