Home GPU Mining in 2026: A Guide to ASIC-Resistant Coins and Profitability

ASIC-resistant coins have become the path forward for individual miners, preserving something close to the original vision of decentralized cryptocurrency mining. These ASIC-resistant coins favor consumer-grade GPUs over specialized hardware, which means regular people can still participate.

This guide covers the most profitable coins to mine at home in 2026, breaks down real profitability numbers, and walks through everything you need to get started. However if you are just new and need a background, here is a beginner guide to crypto mining.

Why ASIC-Resistant Coins Matter for Home Miners

Cryptocurrency mining has changed dramatically since Bitcoin’s early days. What once required a standard computer now demands warehouse-sized facilities filled with purpose-built machines. That’s not a path most of us can follow.

ASIC-resistant coins push back against this centralization. These cryptocurrencies use algorithms that run poorly on specialized mining hardware but work well on the flexible architecture in consumer graphics cards.

This approach prevents wealthy mining operations from dominating network hash rates. It keeps mining power geographically distributed. And it means individuals can still participate meaningfully while on ASIC-Resistant.

Why Decentralization Actually Matters

Bitcoin’s mining network has concentrated among a handful of large operations. This raises real concerns about network security and censorship resistance—if a few players control most of the hash rate, the whole point of decentralization starts to erode.

ASIC-resistant algorithms spread mining power across thousands of individual participants. When no single entity can easily dominate, the network becomes more resilient against attacks and manipulation.

For home miners, this means your contribution actually matters. As an ASIC-resistant coins chaser, your GPU adds real security to the network while generating income. Bitcoin mining can’t offer that anymore.

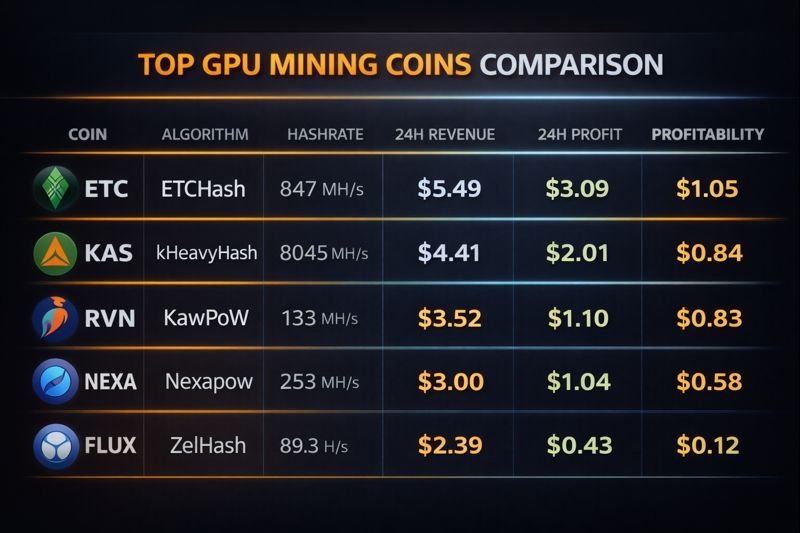

Top GPU Mining Coins for 2026

Picking the right cryptocurrency to mine is your most important decision. Each coin has different profitability potential, network stability, and long-term prospects.

Ravencoin (RVN)

Ravencoin has become one of the go-to options for GPU miners. Its KAWPOW algorithm was built specifically to resist ASIC development while running efficiently on GPUs.

KAWPOW continuously changes its requirements, making it economically impractical to develop specialized hardware. Consumer GPUs stay competitive indefinitely.

Ravencoin focuses on asset tokenization and transfer—actual utility beyond speculation. The development community remains active, which suggests the project has staying power.

Both NVIDIA and AMD cards perform well, giving you flexibility in hardware selection.

Monero (XMR)

Monero is unusual among mining options. Its RandomX algorithm actually favors CPUs over GPUs, though GPU mining still works.

Privacy-focused cryptocurrencies maintain consistent demand regardless of market conditions. Monero’s untraceable transactions serve legitimate privacy needs, creating a stable user base that doesn’t disappear during bear markets.

RandomX requires memory access patterns that CPUs handle efficiently, but high-end GPUs can still generate decent returns, especially when combined with CPU mining on the same system.

Monero’s established reputation and listing on major exchanges means you can easily convert mined XMR to other currencies or cash.

Vertcoin (VTC)

Vertcoin embodies the home mining ethos more than perhaps any other cryptocurrency. Its Verthash algorithm was designed explicitly to keep mining accessible to individuals.

The development team actively monitors for ASIC development and commits to algorithm changes if necessary. This proactive stance gives GPU miners some long-term assurance.

Vertcoin runs well on diverse GPU hardware, including older models—making it a good entry point for beginners with modest equipment.

The smaller market cap means higher volatility but also greater upside potential. Some miners accumulate VTC during quiet periods, betting on future price appreciation.

Ethereum Classic (ETC)

After Ethereum moved to Proof-of-Stake, Ethereum Classic absorbed significant mining attention. The Etchash algorithm provides solid GPU mining opportunities.

Ethereum Classic maintains the original Ethereum codebase with Proof-of-Work consensus. This appeals to miners who believe GPU-secured smart contract platforms have long-term value.

ETC benefits from established infrastructure—numerous exchanges, wallet options, mature mining pools, and well-documented setup procedures.

Hash rate competition has stabilized, creating predictable profitability calculations. This stability helps you plan operations with some confidence.

Hardware Selection: Modern GPUs for Mining

Your GPU choice directly impacts profitability. Modern cards offer significantly better efficiency than older models, though the optimal selection depends on your circumstances. You can follow this this step we created to make a favorable choice.

NVIDIA RTX 40 Series

The RTX 4070 and RTX 4080 deliver excellent mining efficiency. Their Ada Lovelace architecture provides strong hash rates while keeping power consumption reasonable.

Power efficiency matters more than raw performance for profitable mining. The RTX 4070 often outperforms the RTX 4090 when measured by profit per watt consumed.

NVIDIA cards benefit from mature driver support and extensive mining community knowledge. Optimization guides exist for every popular algorithm.

Consider the RTX 4060 Ti for budget-conscious setups. Its lower price point accelerates return on investment despite modest absolute hash rates.

NVIDIA RTX 30 Series

The previous generation RTX 30 series cards now offer compelling value. Used market prices have dropped significantly while mining performance remains competitive.

The RTX 3070 and RTX 3080 hit a sweet spot for many home miners—good availability, reasonable prices, solid performance.

These cards have proven reliability through years of continuous operation. Many miners report running RTX 30 series GPUs around the clock for years without issues.

The RTX 3060 Ti deserves special mention for its outstanding efficiency. This card often appears in profitability rankings despite its mid-range positioning.

AMD RX 7000 Series

AMD’s RDNA 3 architecture brings competitive mining performance. The RX 7800 XT and RX 7900 XTX both perform well across popular algorithms.

AMD cards traditionally excel at memory-intensive algorithms, making them particularly effective for certain ASIC-resistant coins. Ravencoin and Ethereum Classic both benefit from AMD’s architecture.

Driver support for mining has improved substantially. AMD’s open-source driver initiative provides excellent Linux compatibility for dedicated mining rigs.

The RX 7600 offers an affordable entry point with respectable efficiency—worth considering for building initial operations. Compare GPU to ASIC.

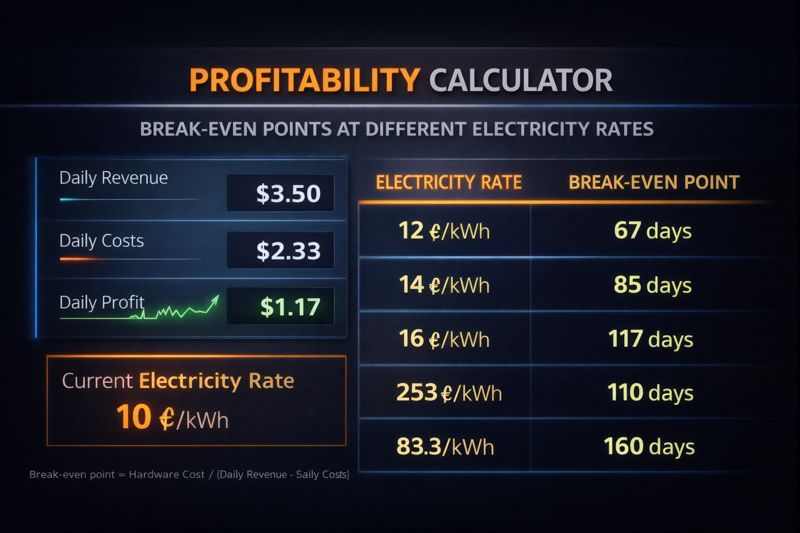

Electricity Costs: The Make-or-Break Factor

Nothing impacts home mining profitability more than electricity costs. Your local utility rates determine whether mining generates profit or losses. Full stop.

Understanding Your True Electricity Cost

Rates below $0.07 per kilowatt-hour create comfortable profit margins for most GPU mining operations. Above this threshold, profitability becomes increasingly dependent on coin prices and algorithm efficiency.

Calculate your actual cost by examining your utility bill carefully. Many providers charge different rates based on time of day or total consumption. These tier structures can significantly impact mining economics.

Include all fees and taxes in your calculations. The advertised rate rarely reflects your true cost per kilowatt-hour. Accurate accounting prevents unpleasant surprises. If you have ability to relocate, this list countries where cryptocurrency mining is still profitable in 2026.

Consider seasonal variations too. Summer cooling requirements combined with potential rate increases can swing operations from profitable to unprofitable.

Profitability Thresholds by Rate

At $0.05/kWh, most modern GPUs generate meaningful profits across multiple coins. This rate provides substantial cushion against market volatility.

Between $0.07 and $0.10/kWh, careful coin selection and hardware optimization become essential. Only the most efficient GPUs mining the most profitable coins remain viable.

Above $0.10/kWh, home GPU mining struggles to break even under normal market conditions. Miners in high-cost areas should explore alternative strategies or wait for more favorable conditions.

Some miners negotiate special rates with utilities or install solar panels. These investments can transform unprofitable locations into viable mining operations.

Mining Pools: Consistent Returns Over Solo Gambles

Solo mining offers the theoretical possibility of keeping entire block rewards. In practice, network difficulty makes this approach impractical for home miners.

Why Pools Make Sense

Mining pools combine hash power from thousands of participants, dramatically increasing the frequency of discovered blocks. Members receive proportional payouts based on their contribution.

The mathematics heavily favor pool participation. A single GPU might take years to find a block solo. Pool mining provides steady, predictable income instead.

Pool fees typically range from 0.5% to 2% of earnings. This small cost provides enormous value through payment consistency and reduced variance.

Most home miners receive daily payouts from pools. This regular income stream helps cover electricity costs and provides some psychological satisfaction—you can see the results of your operation.

Selecting the Right Pool

Pool selection impacts both profitability and payment reliability. Larger pools find blocks more frequently but face more competition. Smaller pools offer potentially higher per-block rewards but less consistent payouts.

Evaluate pools based on fee structure, payment method, and minimum payout thresholds. Some pools require substantial accumulated earnings before releasing payments.

Geographic server location affects your effective hash rate. Choose pools with servers near your location to minimize latency and rejected shares.

Research pool reputation before committing. Established pools like F2Pool and 2Miners have proven track records. Newer pools may offer lower fees but carry higher risk.

Payment Methods Explained

PPS (Pay Per Share) provides immediate payment for each valid share submitted. This method offers maximum consistency but typically charges higher fees.

PPLNS (Pay Per Last N Shares) bases payments on recent contribution when blocks are found. This method rewards loyal miners who maintain consistent hash rate.

Miners prioritizing consistency should favor PPS, while those accepting variance might prefer PPLNS for lower fees.

Setting Up Your Home Mining Operation

Successful home mining requires more than just hardware. Proper setup, configuration, and ongoing management determine long-term success.

Hardware Assembly and Placement

Position your mining rig in a well-ventilated area away from living spaces. GPUs generate substantial heat and noise during continuous operation. You’ll regret putting it in your bedroom.

Adequate cooling prevents thermal throttling and extends hardware lifespan. Consider additional case fans or open-air mining frames for multi-GPU setups.

Ensure your power supply provides adequate wattage with headroom. A 1000W PSU running at 800W operates more efficiently and reliably than one running at capacity.

Use quality power cables and avoid overloading electrical circuits. Mining rigs draw significant continuous power, stressing household electrical systems.

Software Configuration

Mining software options include NiceHash, Phoenix Miner, T-Rex, and NBMiner among others. Each offers different features and algorithm support.

Start with user-friendly options like NiceHash if you’re new to this. These platforms handle coin selection automatically, optimizing for current profitability.

Advanced miners prefer direct pool connections with specialized mining software. This approach offers lower fees and greater control but requires more technical knowledge.

Configure your operating system for stability. Disable automatic updates that might interrupt mining. Set up automatic restart scripts to recover from crashes.

Wallet Security

Protecting your mined coins requires proper wallet security. Hardware wallets like Ledger Nano X provide the highest security for significant holdings.

Never leave substantial funds on exchange wallets or pool accounts. Transfer earnings regularly to wallets you control completely.

Maintain secure backups of wallet recovery phrases. Store these backups in multiple secure locations, protected from fire and theft.

Consider using separate wallets for mining payouts and long-term holdings. This separation simplifies accounting and provides additional security layers. You can see the full guide on how to set up your miner rig at home alone.

Mining Profitability Tools and Calculations

Real-time market conditions constantly shift mining profitability. Effective miners continuously monitor and adjust their operations.

Using WhatToMine and Similar Calculators

WhatToMine remains the standard for GPU mining profitability calculations. Enter your hardware specifications and electricity cost to see real-time earnings estimates.

These calculators compare profitability across dozens of coins simultaneously. Switching to the most profitable coin at any given moment maximizes returns.

Remember that calculator results are estimates based on current conditions. Actual earnings may vary due to pool luck, network difficulty changes, and price movements.

Check profitability multiple times daily during volatile market periods. Coin rankings can shift dramatically within hours.

Mining ROI Timeline Expectations

Realistic GPU mining ROI timelines in 2026 range from 12 to 24 months under favorable conditions. This assumes optimal electricity rates and consistent operation.

Higher electricity costs extend ROI timelines significantly. Miners paying $0.10/kWh might never recover hardware costs through mining alone.

Factor GPU resale value into ROI calculations. Mining GPUs retain substantial value and can be sold to recover investment partially.

Market volatility creates both risk and opportunity. Holding mined coins during price dips and selling during rallies can dramatically improve overall returns.

The AI Computing Pivot and Future Trends

The cryptocurrency mining landscape continues evolving. Smart miners stay ahead by understanding emerging trends and opportunities.

What Happens When Industrial Operations Pivot

Large-scale mining operations are exploring data center retrofitting for AI workloads. This trend creates interesting dynamics for home miners.

As industrial operations shift toward AI computing, GPU mining competition may decrease. Reduced network difficulty improves profitability for remaining miners.

Users mining GPU at home can potentially participate in distributed AI computing networks. These platforms offer alternative income streams using the same GPU hardware.

The convergence of AI and cryptocurrency creates new opportunities. Tokens rewarding AI computation may become the next frontier for GPU miners.

Regulatory Considerations In Mining

Local regulations increasingly impact home GPU mining viability. Some jurisdictions impose restrictions on residential electricity usage for mining.

Research your local regulatory environment before investing in mining hardware. Utility companies in some areas have implemented special rates or restrictions for cryptocurrency mining.

Tax obligations vary significantly by jurisdiction. Maintain detailed records of mining income and expenses for accurate reporting.

Environmental regulations may eventually impact home mining. Stay informed about potential policy changes that could affect operations.

Is Home GPU Mining Right for You?

Home GPU mining in 2026 remains viable for the right candidates. Success requires the proper combination of circumstances and commitment.

Who Should Consider This

Low electricity costs are the single most important factor for profitable home mining. Miners with rates below $0.07/kWh have significant advantages.

Technical aptitude helps but isn’t strictly required. User-friendly mining software has lowered the barrier to entry substantially.

Patience and realistic expectations matter enormously. Mining generates modest returns that accumulate over time rather than instant riches.

Access to well-ventilated space away from living areas improves quality of life. Mining rigs produce constant noise and heat that become annoying in shared spaces.

Getting Started With Mining

Begin by calculating your true electricity cost. This single number determines whether proceeding makes financial sense.

Start mining small with a single GPU at home before scaling up. Learning the basics on modest equipment prevents costly mistakes with larger investments.

Join mining communities on Reddit and Discord. Experienced miners freely share knowledge and help troubleshoot problems.

Research thoroughly before purchasing hardware. The landscape changes rapidly, and today’s best value might not be tomorrow’s. You can check this on watToMine.

Conclusion

Home GPU mining in 2026 occupies a specific niche in the cryptocurrency ecosystem. While Bitcoin mining has moved far beyond individual participation, ASIC-resistant coins preserve something closer to the original vision of decentralized, accessible mining.

Profitability depends on the intersection of electricity costs, hardware efficiency, and coin selection. Miners meeting the right criteria can generate meaningful passive income while supporting network decentralization.

Ravencoin, Monero, Vertcoin, and Ethereum Classic each offer different tradeoffs for home miners. Each provides opportunities for profitable mining with consumer hardware.

Success requires realistic expectations, proper setup, and ongoing optimization. Those willing to invest the effort will find home GPU mining rewarding—both financially and as a way to participate in something larger than yourself.

As industrial operations pivot toward AI and other applications, dedicated GPU miners may find even greater opportunities for ASIC-resistant coins.