Binance Review 2025: Is It Still the #1 Crypto Exchange?

| Rating | Pros | Cons | |

|---|---|---|---|

| Trading Fees | ★★★★★ | Lowest with BNB | – |

| Crypto Selection | ★★★★★ | 350+ coins incl. DeFi/NFTs | – |

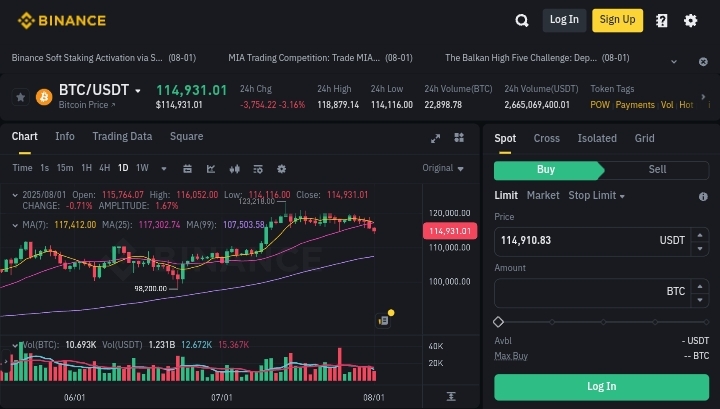

| Interface | ★★★★☆ | Pro & basic modes | Overwhelming for new users |

| Security | ★★★★☆ | SAFU, 2FA, bug bounty | 2019 hack (covered) |

| Staking / Earn | ★★★★★ | Flexible APYs & options | Can confuse beginners |

| Fiat Support | ★★★★☆ | Bank, card, P2P | Varies by region |

| Support | ★★★☆☆ | 24/7 chat, guides | Can be slow at peaks |

| Compliance | ★★★☆☆ | KYC + regional changes | Bans in some countries |

| Derivatives | ★★★★★ | Futures, margin, analytics | High risk for new users |

| Overall Value | ★★★★★ | Great all-in-one platform | – |

The cryptocurrency landscape has evolved dramatically since 2017, but one name continues to dominate the conversation: Binance. As we enter 2025, millions of traders worldwide are asking whether this crypto giant still deserves its crown as the world’s leading exchange. With regulatory challenges, security concerns, and fierce competition from emerging platforms, it’s time for a comprehensive look at what Binance offers today.

The cryptocurrency landscape has evolved dramatically since 2017, but one name continues to dominate the conversation: Binance. As we enter 2025, millions of traders worldwide are asking whether this crypto giant still deserves its crown as the world’s leading exchange. With regulatory challenges, security concerns, and fierce competition from emerging platforms, it’s time for a comprehensive look at what Binance offers today.

Founded by Changpeng Zhao in 2017, Binance transformed from a startup to the world’s largest cryptocurrency exchange in just six months. Today, it processes billions in daily trading volume and serves users across the globe. But recent events, including a $4.3 billion settlement with U.S. authorities and leadership changes, have raised questions about its future dominance.

What is Binance?

Binance is more than just a cryptocurrency exchange. It’s a comprehensive ecosystem that offers spot trading, derivatives, staking, lending, and even its own blockchain network. The platform supports over 350 cryptocurrencies, making it one of the most diverse trading environments available.

Binance is more than just a cryptocurrency exchange. It’s a comprehensive ecosystem that offers spot trading, derivatives, staking, lending, and even its own blockchain network. The platform supports over 350 cryptocurrencies, making it one of the most diverse trading environments available.

At its core, Binance facilitates crypto-to-crypto trading with some of the industry’s lowest fees. The Binance exchange operates on a multi-tier, multi-clustered architecture that ensures high processing speeds and reliability. This technical foundation has allowed Binance to maintain its position despite handling massive trading volumes daily.

The platform’s native token, BNB (Build’N’Build), plays a crucial role in the ecosystem. Originally launched as Binance Coin in 2017, BNB offers users trading fee discounts and serves as the foundation for the BNB Chain. With a market capitalization of approximately $39 billion as of 2023, BNB ranks among the top cryptocurrencies globally.

Key Features That Set Binance Apart

Binance’s feature set extends far beyond basic trading. The platform offers seven different order types for futures trading, including limit orders, market orders, and trailing stop orders. This variety gives traders precise control over their positions and risk management strategies.

The exchange’s Binance Earn program allows users to generate passive income through staking and savings products. Depending on the cryptocurrency and lock-up period, users can earn competitive interest rates on their holdings. This feature has attracted long-term investors looking to maximize their crypto assets’ potential.

Binance Smart Pool represents another innovative offering. This service enables miners to switch between different cryptocurrencies automatically, optimizing their mining profits based on market conditions. The platform also provides Binance Pay, a payment solution that allows users to spend cryptocurrency worldwide with zero fees.

For developers and blockchain projects, Binance Labs serves as an incubator and investment arm. The program has supported over 70 projects through its LaunchPad platform, providing funding, advisory services, and access to Binance’s massive user base. While the platform offer the best exchange, it equally gives the best web3 for user to completely control their assets which is Trust Wallet. Other alternatives includ Exodus Wallet, you may decide between both when you want a total control of your cryptocurrency.

Trading Fees and Cost Structure Explained

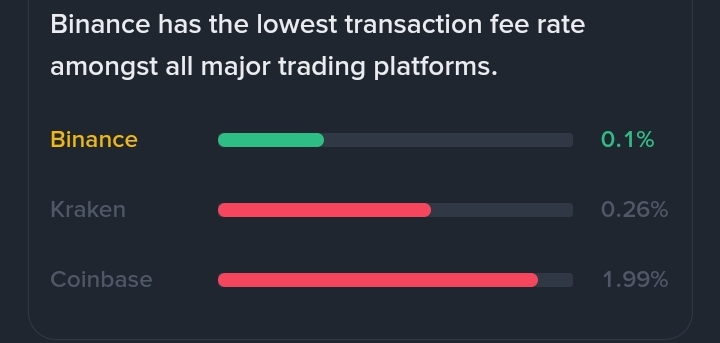

Understanding Binance’s fee structure is crucial for maximizing your trading profits. The exchange employs a maker-taker fee model, with standard trading fees starting at 0.1% for both makers and takers. However, these rates decrease significantly based on your 30-day trading volume and BNB holdings.

Users who pay fees with BNB receive an automatic 25% discount, effectively reducing the base fee to 0.075%. High-volume traders can achieve even lower rates, with VIP levels offering fees as low as 0.02% for makers and 0.04% for takers. This tiered system rewards active traders while keeping costs competitive for casual users.

Withdrawal fees vary by cryptocurrency and network congestion. While Binance doesn’t charge for deposits, withdrawal costs can range from minimal amounts for efficient networks to higher fees for congested blockchains like Ethereum. Always check current withdrawal fees before moving funds off the exchange.

Security Measures and User Protection

Security remains paramount in cryptocurrency trading, and Binance has implemented multiple layers of protection. The exchange uses industry-standard security measures including two-factor authentication (2FA), address safelist, and anti-phishing codes. These features help protect user accounts from unauthorized access.

Despite these measures, Binance has faced security challenges unlike Ledger wallet. In 2019, hackers stole 7,000 Bitcoin worth approximately $40 million. The exchange responded by fully reimbursing affected users from its Secure Asset Fund for Users (SAFU). More recently, in 2022, hackers exploited the BNB Chain, stealing $570 million worth of BNB tokens.

Binance maintains insurance funds and has demonstrated a commitment to user protection. The SAFU fund, established in 2018, allocates 10% of all trading fees to protect users in extreme cases. This proactive approach has helped maintain user confidence despite security incidents.

Global Availability and Regulatory Challenges

Binance’s global reach faces increasing regulatory scrutiny. The exchange has been banned or restricted in numerous countries, including the United States, United Kingdom, and Canada. These restrictions stem from concerns about money laundering, unlicensed operations, and non-compliance with local financial regulations.

In November 2023, Binance pleaded guilty to U.S. federal charges and agreed to pay $4.3 billion in fines. CEO Changpeng Zhao stepped down and paid an additional $50 million penalty. These developments marked a significant turning point for the exchange’s operations and leadership structure.

For U.S. residents, Binance.US operates as a separate entity with limited features compared to the global platform. States including Hawaii, New York, Texas, and Vermont prohibit even Binance.US operations. European users face varying restrictions, with some countries like Belgium ordering complete cessation of services.

Despite challenges, Binance continues expanding in crypto-friendly jurisdictions. The Binance exchange has obtained licenses in countries like Italy, Spain, and France, demonstrating its commitment to regulatory compliance where possible.

How to Use Binance Exchange Safely

Getting started with Binance trading requires careful attention to security and compliance. First, ensure you’re accessing the correct website, as phishing sites frequently target crypto users. Always verify the URL and look for the secure connection indicator in your browser.

Getting started with Binance trading requires careful attention to security and compliance. First, ensure you’re accessing the correct website, as phishing sites frequently target crypto users. Always verify the URL and look for the secure connection indicator in your browser.

Complete the Know Your Customer (KYC) verification process thoroughly. While some users prefer anonymity, verified accounts enjoy higher withdrawal limits and access to all platform features. Provide accurate information to avoid future account restrictions or freezes.

Enable all available security features immediately after account creation. Set up two-factor authentication using an authenticator app rather than SMS. Create a unique, strong password and consider using a password manager. In addition, activate withdrawal address safelist to prevent unauthorized transfers.

Start with small amounts when learning the platform. Practice different order types and explore features gradually. Monitor your positions regularly and set stop-losses to manage risk. Never invest more than you can afford to lose, as cryptocurrency markets remain highly volatile.

Binance vs Competitors

| Feature |  Kraken Kraken |

Bybit Bybit |

||

|---|---|---|---|---|

| Founded | 2017 | 2012 | 2011 | 2018 |

| Headquarters | Global (offshore) | USA | USA | Dubai |

| Regulation | Mixed / improving KYC | Fully regulated (U.S.) | Well-regulated (U.S., EU) | Less regulated / offshore |

| KYC Required | Yes (strict) | Yes | Yes | Yes (less strict) |

| Available Cryptos | 350+ | ~250 | 200+ | ~300 |

| Trading Fees | 0.10% (lower w/ BNB) | 1.49% (retail) | 0.16% / 0.26% | 0.1% / 0.1% |

| Deposit Options | Bank, card, crypto | Bank, card, PayPal | Bank, crypto, wire | Crypto only |

| Derivatives Trading | Yes (futures/options) | No | Yes (limited) | Yes (strong focus) |

| Staking / Earn | Yes (Binance Earn) | Yes (limited) | Yes (secure) | Yes (flexible APYs) |

| NFT Marketplace | Yes | Yes | No | No |

| User Interface | Advanced + beginner modes | Very beginner-friendly | Pro-focused UI | Simple and clean |

| Customer Support | 24/7 chat, improving | Email/chat (slower) | Good, slower response | Fast live chat |

| Best For | All-round users, DeFi | U.S. beginners | Security-first users | Derivatives traders |

Conclusion: Is Binance Still Number One?

Binance maintains its position as the world’s largest cryptocurrency exchange by trading volume, but its dominance faces unprecedented challenges. The platform’s comprehensive features, competitive fees, and massive liquidity continue attracting millions of users worldwide. For experienced traders seeking advanced tools and diverse markets, Binance remains difficult to beat.

However, regulatory pressures and geographic restrictions significantly impact its accessibility. The recent leadership changes and billion-dollar settlements raise questions about future operations and compliance standards. New users must carefully consider their local regulations and risk tolerance before choosing Binance.

Competition from regulated exchanges like Coinbase and emerging decentralized platforms provides alternatives for users prioritizing compliance or decentralization. While Binance adapts to changing regulations, some users may find these alternatives better suited to their needs.

Ultimately, Binance’s suitability depends on your location, experience level, and trading goals. The exchange excels in providing advanced features and market access but requires users to navigate complex regulatory landscapes. As the cryptocurrency industry matures, Binance’s ability to balance innovation with compliance will determine whether it maintains its leading position through 2025 and beyond.

![]()

![]()

![]()