Coinbase Exchange Review: Pros, Cons, and Hidden Fees

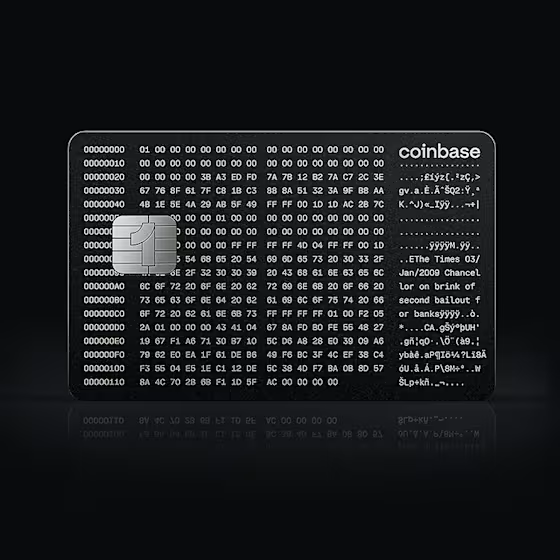

Coinbase has become a household name in cryptocurrency trading, but is it really the best platform for your crypto journey in 2025? With over 108 million users worldwide and custody of more than 12% of all Bitcoin in existence, this exchange certainly commands attention. Yet behind the impressive numbers lie important details about fees, features, and limitations that every trader should understand.

Whether you’re a complete beginner or an experienced trader, this comprehensive review breaks down everything you need to know about Coinbase. We’ll explore the platform’s strengths, uncover its weaknesses, and reveal the hidden costs that might impact your trading profits.

What Is Coinbase and How Does It Work?

Coinbase is the largest U.S.-based cryptocurrency exchange, founded in 2012 by Brian Armstrong and Fred Ehrsam. The platform started as a simple way to buy and sell Bitcoin but has evolved into a comprehensive crypto ecosystem serving over 100 countries.

The exchange operates through multiple products designed for different user types. Coinbase’s main app offers a beginner-friendly interface where users can buy, sell, and store over 250 cryptocurrencies. For more advanced traders, Coinbase Advanced (formerly Coinbase Pro) provides professional trading tools with lower fees and advanced charting capabilities.

What sets Coinbase apart is its regulatory compliance and transparency. As a publicly traded company on NASDAQ since April 2021, Coinbase maintains strict financial reporting standards. The company holds over $400 billion in customer assets and generates billions in annual revenue, making it one of the most financially stable exchanges in the industry.

The platform works by connecting buyers and sellers of cryptocurrency. When you place an order, Coinbase matches it with other users or fulfills it from their own inventory. Your purchased crypto can be stored in Coinbase’s custodial wallet or transferred to your personal wallet for complete control.

Key Features That Set Coinbase Apart

Coinbase’s feature set extends far beyond basic trading, offering tools and services that cater to various crypto needs. The platform’s ecosystem includes everything from simple buying and selling to advanced DeFi integration and institutional-grade custody solutions.

One standout feature is Coinbase One, a subscription service that provides benefits like zero trading fees on orders up to $10,000 monthly, priority customer support, and enhanced staking rewards. For frequent traders, this $29.99 monthly subscription can result in significant savings compared to standard fees.

The platform’s staking service allows users to earn passive income on supported cryptocurrencies. Currently offering staking on 9+ coins including Ethereum, Cardano, and Solana, users can earn annual yields ranging from 2% to over 10% depending on the asset. The staking process is completely automated, requiring no technical knowledge.

Coinbase Wallet represents another powerful feature, functioning as a separate non-custodial wallet app. This allows users to interact with decentralized applications (dApps), store NFTs, and maintain complete control over their private keys. The wallet seamlessly integrates with the main Coinbase app while providing the freedom of self-custody.

For businesses and developers, Coinbase offers specialized tools including Commerce for accepting crypto payments, a comprehensive API for building applications, and the recently launched Developer Platform. These services position Coinbase as more than just an exchange, but as infrastructure for the broader crypto economy.

Understanding Coinbase’s Fee Structure

Coinbase’s fee structure remains one of the most criticized aspects of the platform, and for good reason. The exchange employs a complex pricing model that can confuse new users and significantly impact trading profitability.

Standard Coinbase users face a spread of approximately 0.5% on all trades, plus additional fees that vary based on payment method and transaction size. For purchases under $200, fees typically range from $0.99 to $2.99. Larger transactions incur percentage-based fees ranging from 1.49% for bank transfers to 3.99% for debit card purchases.

Here’s where it gets expensive for active traders. A $1,000 Bitcoin purchase via bank transfer would incur approximately $14.90 in fees, while the same purchase with a debit card costs $39.90. These fees quickly add up, especially for users making frequent trades or dollar-cost averaging into positions.

Coinbase Advanced offers significantly lower fees with a maker-taker model starting at 0.4% for makers and 0.6% for takers. High-volume traders can reduce fees to as low as 0.05% for makers and 0.15% for takers by trading over $300 million in 30 days. However, most retail traders won’t reach these volume tiers.

Hidden costs extend beyond trading fees. Coinbase charges for cryptocurrency conversions between different assets, typically around 2%. Withdrawing fiat currency to your bank account is free for ACH transfers but costs $25 for wire transfers. Even sending crypto to external wallets incurs network fees, though Coinbase doesn’t add additional charges here.

Security Measures and Insurance Protection

Security stands as Coinbase’s strongest selling point, with the platform implementing industry-leading measures to protect user assets. The exchange stores 98% of customer cryptocurrency in offline cold storage, dramatically reducing hacking risks compared to hot wallet storage.

The platform employs multiple layers of security including two-factor authentication, biometric login options, and address safelisting for withdrawals. Coinbase also maintains insurance coverage for digital assets stored on their platform, though this insurance only covers breaches of Coinbase’s security, not individual account compromises due to user error.

For U.S. customers, USD balances are FDIC insured up to $250,000 per customer, providing traditional banking-level protection for fiat holdings. This insurance applies even if Coinbase itself fails, offering peace of mind for users holding cash on the platform.

The company’s security track record speaks volumes. Despite being a major target for hackers, Coinbase has never suffered a significant breach resulting in customer fund losses. In 2019, the platform successfully defended against a sophisticated attack involving Firefox zero-day vulnerabilities, demonstrating their proactive security approach.

Recent transparency initiatives include regular proof-of-reserves audits and detailed security whitepapers. Coinbase’s bug bounty program offers rewards up to $250,000 for discovering critical vulnerabilities, incentivizing ethical hackers to help strengthen the platform’s defenses. Compare with Ledger wallet.

Pros and Cons: An Honest Assessment

The advantages of using Coinbase are compelling for many users. The platform’s user-friendly interface makes cryptocurrency accessible to complete beginners, while regulatory compliance provides confidence in an often murky industry. With support for over 250 cryptocurrencies, users have access to most major tokens and many emerging projects.

Educational resources represent another significant advantage. Coinbase Earn allows users to earn free cryptocurrency by learning about different projects, providing both education and financial incentive. The platform’s extensive help center and responsive customer support (especially for Coinbase One members) help users navigate common issues.

However, Coinbase’s drawbacks cannot be ignored. High fees remain the primary complaint, particularly for small transactions or frequent traders. The platform’s conservative approach to listing new tokens means users miss early opportunities available on other exchanges. Geographic restrictions limit features in certain regions, with some U.S. states having reduced functionality.

Customer service quality varies dramatically between standard and premium users. While Coinbase One members enjoy priority support, regular users often report long wait times and generic responses. The platform’s history of technical issues during high-volume periods has frustrated traders trying to capitalize on market movements.

Privacy-conscious users may find Coinbase’s extensive KYC requirements off-putting. The platform requires government ID verification, tax reporting, and transaction monitoring that goes beyond many competitors. While this ensures regulatory compliance, it eliminates the pseudonymous nature that attracts many to cryptocurrency.

Comparing Coinbase to Major Competitors

When stacked against competitors, Coinbase reveals both strengths and weaknesses. Binance.US offers significantly lower trading fees at 0.1% for spot trading, making it more attractive for active traders. However, Binance.US provides fewer cryptocurrencies and faces ongoing regulatory challenges in the United States.

Kraken presents a middle ground with fees starting at 0.16% and a strong security reputation rivaling Coinbase. The platform offers more advanced trading features and better customer support but lacks Coinbase’s intuitive interface and educational resources. Kraken’s recent expansion into futures trading provides options Coinbase doesn’t offer U.S. customers.

Gemini competes directly with Coinbase for beginner-friendly trading, offering similar ease of use and regulatory compliance. Gemini’s ActiveTrader platform provides lower fees than standard Coinbase, though still higher than Binance.US or Kraken. The platform’s focus on security and insurance matches Coinbase’s standards.

For institutional investors, Coinbase Prime competes with specialized platforms like Bakkt and Fidelity Digital Assets. While Coinbase offers comprehensive services and deep liquidity, some institutions prefer the traditional finance pedigree of competitors. The recent partnership with BlackRock demonstrates Coinbase’s growing institutional credibility.

International users often prefer global exchanges like Binance or OKX due to wider feature sets and lower fees. Coinbase’s U.S. focus limits certain products like derivatives trading and higher leverage options available elsewhere. However, this conservative approach provides regulatory clarity that many traders value.

Getting Started: A Step-by-Step Guide

Beginning your Coinbase journey requires just a few minutes and basic personal information. Start by visiting Coinbase.com or downloading the mobile app, then click “Get Started” to begin the registration process. You’ll need to provide your full name, email address, and create a strong password.

Identity verification follows account creation. Coinbase requires a government-issued photo ID such as a driver’s license or passport. The platform uses automated verification that typically approves accounts within minutes, though manual review may take up to 48 hours. You’ll also need to verify your phone number for two-factor authentication.

Funding your account offers multiple options with varying fees and processing times. Bank account connections via ACH transfer provide the lowest fees but take 3-5 business days to clear. Debit cards enable instant purchases but carry higher fees. Wire transfers work for large deposits but cost $10 to initiate and $25 to withdraw.

Once funded, navigate to the “Buy/Sell” tab to make your first purchase. Enter the dollar amount or cryptocurrency quantity you want to buy, review the fees clearly displayed, and confirm your order. Your purchased cryptocurrency appears instantly in your portfolio, ready for holding, trading, or transferring.

For better prices and lower fees, consider using Coinbase Advanced after gaining experience. The interface appears more complex but offers significant fee savings and advanced order types. Start with small amounts to familiarize yourself with the platform before making larger trades.

Final Verdict: Is Coinbase Right for You?

Coinbase remains an excellent choice for cryptocurrency beginners prioritizing security, ease of use, and regulatory compliance over low fees. The platform’s intuitive interface, educational resources, and strong track record make it ideal for those taking their first steps into crypto investing.

For active traders and fee-conscious users, Coinbase presents challenges. The high fee structure significantly impacts profitability for frequent traders or those making small purchases. Alternatives like Binance.US or Kraken offer better value for users comfortable with slightly more complex interfaces.

Long-term investors who plan to buy and hold benefit from Coinbase’s security measures and insurance protections. The platform’s staking options provide passive income opportunities, while features like recurring purchases automate dollar-cost averaging strategies. Coinbase One membership makes sense for users trading at least $2,000 monthly.

Institutional users and high-net-worth individuals find value in Coinbase’s regulatory compliance and custody solutions. The platform’s public company status adds transparency uncommon in the crypto industry. Recent partnerships with traditional finance giants like BlackRock validate Coinbase’s institutional approach.

Ultimately, Coinbase trading platform serves its target audience well despite notable drawbacks. Beginners gain a safe, regulated entry point into cryptocurrency, while the platform’s expanding feature set accommodates growing expertise. Just remember to factor in the higher fees when calculating potential returns, and consider graduating to Coinbase Advanced or alternative platforms as your trading volume increases.