Crypto.com Review: Features, Fees, Pros & Cons

Crypto.com Visit Crypto.com

Visit Crypto.com

Crypto.com has emerged as one of the most prominent cryptocurrency exchanges globally, serving over 100 million users worldwide. This comprehensive review examines whether Crypto.com deserves its reputation as a leading crypto platform in 2025.

The Singapore-based exchange offers far more than just cryptocurrency trading. From traditional stocks and ETFs to innovative crypto derivatives and sports event trading, Crypto.com has evolved into a comprehensive financial ecosystem. But does this jack-of-all-trades approach make it the right choice for your crypto journey?

What Is Crypto.com and How Does It Work?

Crypto.com is a global cryptocurrency exchange and financial services platform that enables users to buy, sell, trade, and manage digital assets. Founded in 2016 as Monaco, the company rebranded to Crypto.com in 2018 after purchasing the domain from cryptography researcher Matt Blaze for a reported $5-10 million.

Crypto.com platform operates through multiple channels. Users can access services via the mobile app, which serves as the primary interface for US investors. The company also offers a web-based exchange platform, a non-custodial DeFi wallet called Onchain, and an NFT marketplace.

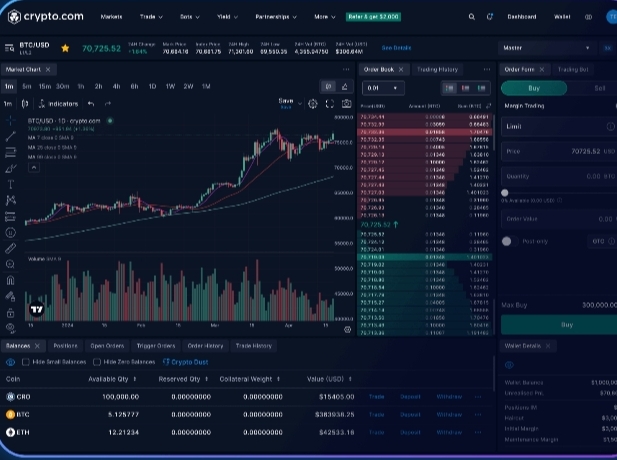

At its core, Crypto.com functions as a cryptocurrency brokerage. Users deposit fiat currency or transfer existing crypto holdings to trade over 400 different cryptocurrencies. The platform matches buyers and sellers, facilitating trades while charging fees based on transaction volume and whether users hold CRO, the platform’s native token.

Beyond basic trading, Crypto.com has expanded into traditional finance. The platform now offers commission-free trading of US stocks, ETFs, and fractional shares through Foris Capital US LLC. This integration of crypto and traditional assets sets Crypto.com apart from many pure-play crypto exchanges.

Key Features That Set Crypto.com Apart

Crypto.com’s feature set extends well beyond typical cryptocurrency trading. The platform has built a comprehensive ecosystem designed to serve both crypto newcomers and experienced traders.

The Crypto.com mobile app stands as the platform’s flagship product. Available on iOS and Android, the app provides seamless access to buying, selling, and managing over 400 cryptocurrencies. The interface prioritizes user experience, making it simple for beginners to navigate while offering advanced features for seasoned traders.

One standout feature is the Crypto.com Visa Card, which allows users to spend cryptocurrency anywhere Visa is accepted. Cardholders earn up to 5% back in CRO tokens on purchases, effectively bridging the gap between digital assets and everyday spending. The card integrates directly with the mobile app for easy management.

For diversification-minded investors, Crypto Baskets offer pre-made portfolios across 15 different themes. Options range from the simple BTC-ETH Duo to specialized baskets focusing on meme coins, AI projects, or the Solana ecosystem. These baskets automatically rebalance according to pre-set ratios, though users maintain full control to adjust holdings.

The platform’s staking program provides passive income opportunities. Users can stake various cryptocurrencies including Ethereum, Solana, and Cronos to earn rewards. Depending on the blockchain protocol, rewards distribute up to three times weekly, though Crypto.com takes a 20% or higher cut of earned rewards.

Advanced traders benefit from sophisticated options trading features. Strike options starting at $10 let traders capitalize on short-term volatility across major cryptocurrencies. UpDown options provide another derivatives product, allowing traders to profit from price movements without owning the underlying asset.

Crypto.com’s Fee Structure

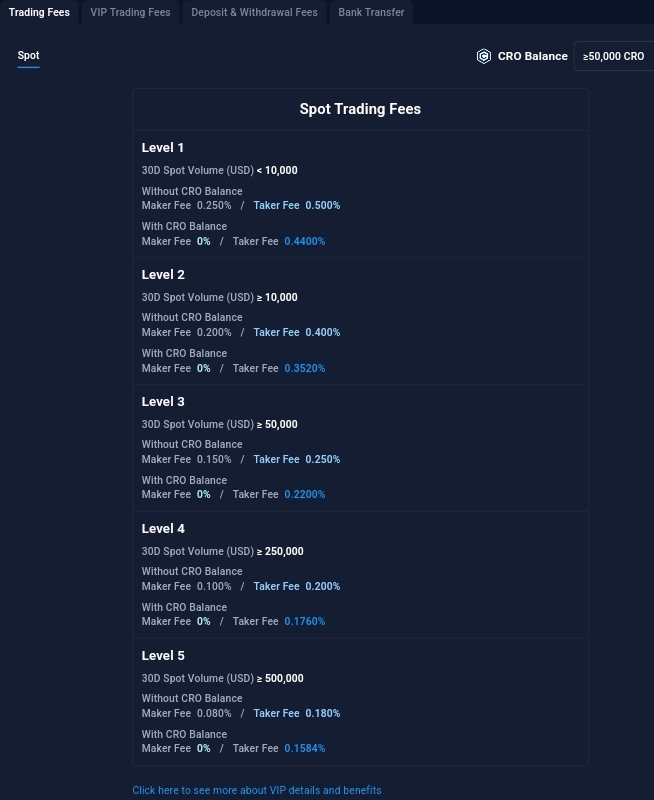

Crypto.com employs a maker/taker fee model that rewards high-volume traders. Understanding this structure is crucial for managing trading costs effectively.

Maker fees apply when you place limit orders that don’t immediately match with existing orders. Taker fees apply to market orders that execute instantly against the order book. Without CRO lockup, fees range from 0.250% for makers and 0.500% for takers on low volumes, down to 0.080% and 0.180% respectively for volumes exceeding $500,000.

The fee structure becomes significantly more attractive with CRO lockup. Makers pay 0% fees across all volume tiers, while taker fees range from 0.4400% down to 0.1584% for high-volume traders. This incentivizes users to hold the platform’s native token.

Additional fees apply for specific services. Credit and debit card purchases incur higher fees after the initial 30-day promotional period. Withdrawal fees vary by cryptocurrency – for example, Dogecoin carries a 6 DOGE withdrawal fee with a 12 DOGE minimum balance requirement.

The platform charges a $100 fee for transferring assets out of your Crypto.com account. Forced liquidations on leveraged positions incur a 0.5% fee. While these fees align with industry standards, they can add up for active traders who don’t optimize their trading patterns.

Security Measures and Trustworthiness

Security remains paramount in cryptocurrency trading, and Crypto.com has implemented multiple layers of protection. The platform uses industry-standard encryption, two-factor authentication, and continuous account monitoring to safeguard user assets.

All fiat currencies are held in regulated custodian bank accounts, providing traditional banking protections. The platform also offers SIPC insurance coverage up to $500,000 for stock and ETF holdings, matching protections offered by traditional brokerages.

However, Crypto.com’s security history includes one significant incident. In January 2022, hackers stole $15 million worth of Bitcoin and Ethereum from 483 user accounts. The company’s response demonstrated both vulnerability and responsibility – they immediately suspended withdrawals, investigated thoroughly, and fully reimbursed all affected users.

Following the hack, Crypto.com implemented the Account Protection Program (APP) for additional security. The platform now requires multiple confirmations before deposits unlock, with the number varying by cryptocurrency. Bitcoin requires two confirmations while Ethereum needs 64, ensuring transactions are legitimate before funds become available.

The platform’s regulatory compliance adds another layer of trust. Crypto.com holds money transmitter licenses across multiple US states and is registered with FinCEN for anti-money laundering compliance. The company’s derivatives trading features are regulated by the Commodity Futures Trading Commission (CFTC).

Despite these security measures, Crypto.com maintains an F rating from the Better Business Bureau. The BBB cites the company’s failure to respond to multiple customer complaints as the reason for this low rating, raising concerns about customer service quality.

Pros and Cons: Is Crypto.com Right for You?

Evaluating Crypto.com requires weighing its impressive features against notable limitations.

The platform’s strengths are considerable. With over 400 cryptocurrencies available, Crypto.com offers one of the industry’s most extensive selections. The addition of commission-free stocks and ETFs creates a one-stop shop for diversified investing. The mobile app consistently earns high ratings – 4.6/5 on Apple Store and 4.5/5 on Google Play – reflecting user satisfaction with the interface.

Reward opportunities abound through multiple channels. The Visa Card’s 5% cashback in CRO tokens provides tangible value for everyday spending. The Rewards+ loyalty program automatically enrolls users and unlocks perks based on trading volume. Staking services offer passive income across numerous cryptocurrencies.

Educational resources through Crypto.com University help beginners navigate the complex crypto landscape. The platform provides detailed trading strategy explanations, security guides, and a comprehensive glossary of terms. This commitment to education sets Crypto.com apart from exchanges that assume user expertise.

However, significant drawbacks exist. New York residents cannot access the platform at all, eliminating a major US market. Customer service remains problematic – the chat function relies on pre-written responses, making it difficult to resolve complex issues. The BBB’s F rating reflects ongoing customer service challenges.

Fee structures, while competitive for high-volume traders with CRO holdings, can be expensive for casual users. Credit and debit card fees are particularly high after the promotional period. The $100 withdrawal fee for transferring assets off-platform may trap smaller investors.

How Crypto.com Compares to Competitors

Understanding how Crypto.com trading platform stacks up against alternatives helps determine if it’s your best option.

Compared to Coinbase, Crypto.com offers a larger cryptocurrency selection and includes traditional securities trading. However, Coinbase maintains a much better BBB rating (A-) and provides superior customer support through phone, email, and live chat. Coinbase’s simpler fee structure may appeal to beginners, though active traders might prefer Crypto.com’s volume-based discounts.

Binance, the world’s largest crypto exchange by volume, offers even more trading pairs and typically lower fees. However, Binance faces significant regulatory challenges in the US, with limited functionality for American users. Crypto.com’s stronger US regulatory compliance makes it a more stable choice for US-based traders.

Kraken provides another established alternative with excellent security history and responsive customer support. While Kraken offers fewer cryptocurrencies than Crypto.com, its straightforward fee structure and professional trading tools appeal to serious traders. Kraken lacks Crypto.com’s rewards programs and traditional securities trading.

For institutional investors, Crypto.com competes with platforms like Gemini and Coinbase Prime. While these platforms offer superior custody solutions and regulatory clarity, Crypto.com’s broader feature set and global reach provide unique advantages for institutions seeking comprehensive services. Consider ByBit exchange for low fee trading.

Getting Started with Crypto.com

Opening a Crypto.com account requires just $1 minimum deposit, making it accessible to investors at any level. The signup process follows standard KYC (Know Your Customer) procedures, requiring government-issued ID and address verification.

New users benefit from promotional offers, including fee-free credit/debit card purchases for the first 30 days. The platform also offers referral bonuses up to $2,000 for each friend you bring aboard, plus 50% of their trading fees.

The mobile app guides users through initial setup with helpful tutorials. Start by funding your account via bank transfer for the lowest fees. Credit and debit cards provide instant funding but incur higher costs after the promotional period.

Once funded, explore the various features gradually. Begin with simple spot trading of major cryptocurrencies like Bitcoin or Ethereum. As comfort grows, investigate staking opportunities, Crypto Baskets for diversification, or the Visa Card for spending rewards.

Take advantage of Crypto.com University’s educational resources before diving into advanced features. Understanding concepts like maker/taker fees, staking rewards, and security best practices will improve your trading experience and protect your investments.

Final Verdict: Should You Choose Crypto.com?

Crypto.com app stands as a feature-rich platform best suited for mobile-first traders seeking diverse investment options. The exchange excels at bridging traditional and crypto finance, offering everything from Bitcoin to US stocks under one roof.

For beginners, the intuitive mobile interface and educational resources provide a gentle introduction to cryptocurrency. The ability to start with just $1 makes experimentation affordable. However, the limited customer support may frustrate users needing assistance.

Active traders benefit most from Crypto.com’s ecosystem. Volume-based fee discounts, especially with CRO lockup, create competitive pricing for frequent traders. The variety of trading options – from spot trading to derivatives – accommodates diverse strategies.

The trading platform’s rewards programs offer genuine value for users willing to engage fully. Between the Visa Card cashback, staking rewards, and loyalty program perks, committed users can offset trading fees through smart platform utilization.

Consider alternatives if you prioritize customer service, live in New York, or prefer simpler fee structures. The platform’s complexity, while offering opportunities, may overwhelm users seeking basic buy-and-hold cryptocurrency investing.

Ultimately, Crypto.com trading platform represents the evolution of cryptocurrency exchanges into comprehensive financial platforms. While not perfect, its combination of features, security measures, and global reach makes it a strong choice for users ready to embrace the full potential of digital asset investing. Just remember to start small, learn continuously, and never invest more than you can afford to lose in the volatile crypto markets.