Gemini Crypto Exchange Review: Is It Safe and Reliable for Crypto Trading?

Gemini exchange stands out as a secure, US-regulated cryptocurrency trading platform that has built its reputation on trust and compliance since 2014. Founded by Cameron and Tyler Winklevoss, this platform offers a comprehensive solution for buying, selling, and storing digital assets.

What sets Gemini apart in the crowded crypto exchange market? The answer lies in its unwavering commitment to security and regulatory compliance. While many exchanges operate in regulatory gray areas, Gemini has pursued a “ask for permission, not forgiveness” approach from day one.

What Is Gemini and Why Should You Care?

Gemini Trust Company, LLC operates as more than just another cryptocurrency exchange. It functions as a fully licensed and regulated platform that bridges the gap between traditional finance and the digital asset ecosystem. The exchange supports over 150 cryptocurrencies, including Bitcoin, Ethereum, and its own stablecoin, the Gemini dollar (GUSD).

The platform caters to various user types through its tiered service structure. Casual investors can use the simple interface for basic buying and selling, while professional traders access advanced features through Gemini Active Trader. This dual approach ensures that whether you’re making your first Bitcoin purchase or executing complex trading strategies, Gemini provides the appropriate tools.

Security remains paramount at Gemini. The exchange stores the majority of user funds in offline “cold storage” while maintaining insured “hot wallets” for immediate trading needs. This approach significantly reduces the risk of large-scale hacks that have plagued other exchanges throughout crypto history.

The Winklevoss Vision: Building Trust in Crypto

Cameron and Tyler Winklevoss didn’t just stumble into cryptocurrency. As early Bitcoin investors, they experienced firsthand the challenges of securely managing digital assets. Their frustration with existing platforms led them to create Gemini with a clear mission: deliver the first trusted platform focused on strong security controls and compliance.

The twins’ background adds credibility to their venture. Beyond their famous legal battle with Mark Zuckerberg over Facebook, they’ve demonstrated a long-term commitment to cryptocurrency adoption. Their exchange launched in October 2015, making it one of the oldest continuously operating platforms in the United States.

Gemini’s regulatory-first approach has paid dividends. The exchange holds a Limited Purpose Trust Charter from the New York Department of Financial Services, one of the strictest financial regulators in the world. This charter allows Gemini to operate as a qualified custodian, meaning it can hold customer assets in trust according to banking compliance standards.

Security Features That Set Gemini Apart

When it comes to protecting your cryptocurrency, Gemini implements multiple layers of security that go beyond industry standards. The exchange was the first to introduce hardware security key support across mobile devices, providing the strongest level of account protection available.

Two-factor authentication isn’t just recommended on Gemini—it’s mandatory. Every user must enable this additional security layer, ensuring that even if login credentials are compromised, accounts remain protected. The platform also offers an “Approved Addresses” feature, allowing users to restrict withdrawals to pre-approved wallet addresses only.

Gemini’s security certifications speak volumes about its commitment. The exchange holds ISO 27001:2013 certification, validating its Information Security Management System. It was also the first crypto exchange to obtain SOC 1 Type 2 and SOC 2 Type 2 certifications, with examinations conducted by Deloitte.

Insurance coverage provides an additional safety net. Gemini maintains up to $200 million in cryptocurrency insurance for losses from theft resulting from exchange hacks, fraudulent transfers initiated by Gemini, or theft by employees. While this doesn’t cover individual account compromises due to user error, it demonstrates the platform’s commitment to protecting customer assets.

Trading on Gemini: Features and Functionality

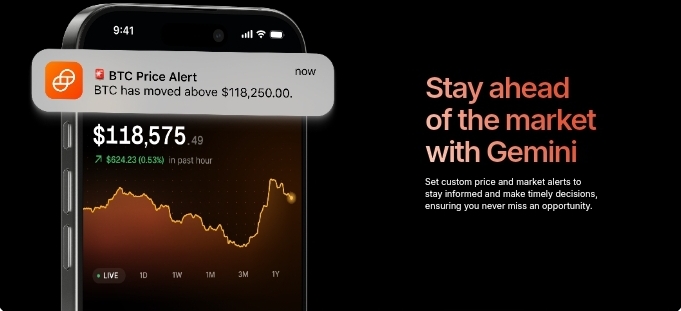

Gemini operates 24/7, allowing users to trade cryptocurrencies at any time. The platform supports various order types to accommodate different trading strategies. Market orders execute immediately at the best available price, while limit orders provide more control over execution prices.

Advanced traders can utilize several sophisticated order types. Good ’til canceled (GTC) orders remain active until filled or manually canceled. Immediate-or-cancel (IOC) orders attempt to fill immediately and cancel any unfilled portion. Stop-limit orders help manage risk by triggering trades at predetermined price levels.

One notable limitation is the absence of margin trading. Unlike some competitors, Gemini requires all orders to be fully funded, meaning you can only trade with assets you actually own. The platform also doesn’t support short selling, which may disappoint some advanced traders but aligns with its conservative, security-first approach.

The Gemini Active Trader platform caters to professional traders with advanced charting tools, order books, and detailed market data. Users can trade over 70 USD/crypto pairs and more than 17 crypto/crypto pairs, providing ample opportunities for portfolio diversification.

Understanding Gemini’s Fee Structure

Gemini’s fee structure varies depending on how you trade. The platform maintains separate fee schedules for different services, ensuring transparency in pricing. Active Trader users enjoy lower fees based on their 30-day trading volume, with maker fees ranging from 0.20% to 0.00% and taker fees from 0.40% to 0.30%.

For casual users accessing Gemini through the mobile app or web interface, convenience fees apply. These fees are higher than Active Trader rates but include the simplicity of instant execution. The platform clearly displays all fees before order confirmation, eliminating surprises.

Deposit and withdrawal fees remain competitive. ACH transfers are free, making it cost-effective to move funds between your bank and Gemini. Wire transfers incur standard banking fees, while cryptocurrency withdrawals have network-specific fees that vary by blockchain congestion.

The Gemini dollar (GUSD) offers unique fee advantages. As Gemini’s native stablecoin, GUSD transactions often have reduced or waived fees when used within the Gemini ecosystem. This makes it an attractive option for traders looking to minimize costs while maintaining USD value stability.

Products and Services Beyond Basic Trading

Gemini has expanded far beyond simple cryptocurrency trading. The platform offers a comprehensive suite of products designed to serve various user needs. Gemini Custody provides institutional-grade storage solutions for large investors, while Gemini Clearing facilitates off-exchange trades between qualified parties.

The acquisition of Nifty Gateway in 2019 positioned Gemini in the NFT marketplace. This platform allows users to buy, sell, and store non-fungible tokens, expanding Gemini’s reach beyond traditional cryptocurrencies. The integration with Gemini’s infrastructure provides NFT traders with the same security and compliance standards.

Gemini Pay represents another innovation. This payment solution allows users to spend cryptocurrency at participating merchants, bridging the gap between digital assets and everyday commerce. The feature integrates seamlessly with the main Gemini app, making crypto spending as simple as traditional payment methods.

The platform’s partnership with Samsung deserves special mention. Samsung smartphone users can link their Samsung Blockchain Wallets directly to Gemini accounts, enabling seamless balance viewing and crypto transfers. This collaboration demonstrates Gemini’s commitment to mainstream adoption through strategic partnerships.

Regulatory Challenges and International Expansion

Gemini’s regulatory journey hasn’t been without challenges. The exchange has faced scrutiny from various regulatory bodies, including the Securities and Exchange Commission and the Commodity Futures Trading Commission. However, its proactive compliance approach has generally served it well.

The Gemini Earn program controversy highlighted the complex regulatory environment. Launched in partnership with Genesis, the program promised high returns on crypto deposits. Following Genesis’s bankruptcy and regulatory action, Gemini worked to return over $1.1 billion to affected customers, demonstrating its commitment to user protection even in adverse circumstances.

International expansion continues despite regulatory headwinds. Gemini operates in over 70 countries, with European headquarters recently relocated to Malta. The platform obtained crypto registration in France, allowing service expansion in that market. Each new jurisdiction requires careful navigation of local regulations, but Gemini’s compliance-first approach facilitates this process.

The exchange’s ability to adapt to changing regulations while maintaining service quality sets it apart. Rather than operating in regulatory gray areas, Gemini works directly with regulators to ensure full compliance, even if this means slower expansion or feature limitations compared to less regulated competitors.

Is Gemini the Right Exchange for You?

Choosing Gemini depends on your priorities as a cryptocurrency trader or investor. The platform excels in security, regulatory compliance, and user protection. These strengths make it particularly attractive for users who value safety over cutting-edge features or the lowest possible fees.

New cryptocurrency investors will appreciate Gemini’s user-friendly interface and educational resources. The platform doesn’t overwhelm beginners with complex features, instead providing a clear path from account creation to first purchase. The mandatory security features protect newcomers from common mistakes that could compromise their assets. Try It Today

Professional traders might find some limitations frustrating. The absence of margin trading and derivatives restricts advanced strategies. However, traders who prioritize security and regulatory compliance over leverage will find Gemini’s Active Trader platform comprehensive and reliable.

The platform’s track record speaks for itself. Despite operating since 2014, Gemini has never suffered a major security breach. Its insurance coverage, regulatory compliance, and security certifications provide multiple layers of protection that few exchanges can match. For users seeking a trustworthy platform to buy, sell, and store cryptocurrency, Gemini remains one of the safest choices available in 2025. Compare platform with binance, Coinbase, Kraken, ByBit and more.