Effects of Upcoming Halving In 2028 (Bitcoin and Other PoW Coins)

⛏️ Bitcoin Halving Countdown

Next Bitcoin Halving is estimated around April 22, 2028.

Bitcoin’s halving mechanism stands as one of cryptocurrency’s most anticipated events. Every four years, this pre-programmed reduction in mining rewards sends ripples through the entire crypto ecosystem. The next Bitcoin halving, expected around April 2028, will slash block rewards from 3.125 to 1.5625 BTC. This systematic supply reduction affects not just Bitcoin but influences the entire Proof-of-Work landscape, from mining profitability to market psychology.

The halving event represents more than a technical adjustment. It embodies Bitcoin’s deflationary design philosophy and serves as a catalyst for market movements. Understanding these halvings becomes crucial for miners calculating their operational viability and investors positioning for potential price movements.

What is a halving event in crypto?

A halving event cuts the reward for mining new blocks exactly in half. Bitcoin miners currently receive 3.125 BTC for each block they successfully mine. When the next halving occurs, this reward drops to 1.5625 BTC. This mechanism operates automatically through Bitcoin’s code, triggering every 210,000 blocks.

The halving connects directly to Bitcoin’s hard cap of 21 million coins. By progressively reducing new coin issuance, the protocol ensures scarcity increases over time. This design mimics precious metals like gold, where extraction becomes progressively harder and more expensive.

The mathematical precision behind halvings creates predictable monetary policy. Unlike central banks that can print money at will, Bitcoin’s supply schedule remains immutable. This predictability allows market participants to plan years in advance.

Historical Bitcoin halving timeline

Bitcoin’s halving history reveals a pattern of significant market impacts. The first halving in November 2012 reduced rewards from 50 to 25 BTC. Bitcoin’s price sat at $12.35 on halving day but reached $127 within 150 days.

The 2016 halving cut rewards to 12.5 BTC when Bitcoin traded at $650. The following bull run pushed prices above $20,000 by late 2017. The 2020 halving occurred amid global monetary expansion, with Bitcoin at $8,821. This event preceded the historic rally to $69,000 in 2021.

The most recent halving on April 20, 2024, showed different dynamics. Bitcoin traded at $64,994 on halving day but actually declined to $60,252 over the next 150 days. This deviation from historical patterns highlights how market maturity and external factors increasingly influence post-halving performance.

Why Bitcoin Halving Matters

Supply and demand dynamics

Halving events create artificial scarcity by reducing new Bitcoin supply. Currently, 900 new bitcoins enter circulation daily through mining rewards. After the 2028 halving, this number drops to just 450 BTC per day. This 50% reduction in new supply occurs regardless of demand levels.

Traditional commodities face variable supply based on market conditions. Oil producers can increase drilling when prices rise. Gold miners can expand operations. Bitcoin’s supply remains algorithmically fixed, creating unique economic dynamics.

The scarcity effect compounds over time. With 19.5 million bitcoins already mined, only 1.5 million remain. Each halving makes remaining bitcoins exponentially harder to obtain through mining.

Market psychology and investor behavior

Halvings generate predictable cycles of market sentiment. Anticipation typically builds 6-12 months before the event. Media coverage increases, drawing new investors curious about the “guaranteed” supply shock.

The “buy the rumor, sell the news” phenomenon often manifests around halvings. Prices frequently rise leading up to the event as speculators position themselves. Some traders exit positions immediately after the crypto halve, creating short-term volatility.

Long-term holders view halvings differently than traders. They focus on the cumulative effect of reduced supply over years rather than immediate price action. This divergence in time horizons creates complex market dynamics around each halving.

Impact of the 2028 Bitcoin Halving

Expected block reward changes

The 2028 halving will reduce block rewards from 3.125 to 1.5625 BTC. This represents just 3.125% of the original 50 BTC reward from 2009. Miners will need to process the same computational work for half the bitcoin reward.

Transaction fees will play an increasingly important role in miner compensation. Currently, fees represent 10-20% of total miner revenue. Post-2028, this percentage must increase for mining to remain profitable at current price levels.

The reduced subsidy impacts Bitcoin’s inflation rate dramatically. Annual inflation will drop from approximately 0.9% to 0.45%, making Bitcoin’s monetary policy tighter than most developed nations’ inflation targets.

Mining difficulty and hash rate adjustments

Bitcoin’s network automatically adjusts mining difficulty every 2,016 blocks. This mechanism ensures blocks continue being produced approximately every 10 minutes. When unprofitable miners shut down post-halving, difficulty decreases to maintain block time.

Historical data shows temporary hash rate drops of 15-25% following halvings. The 2020 halving saw hash rate decline from 120 EH/s to 90 EH/s before recovering. Efficient miners absorb market share from those forced to cease operations.

Large-scale mining operations with access to cheap electricity survive these transitions. Miners paying more than $0.05 per kWh often struggle to remain profitable post-halving. This consolidation trend accelerates with each successive halve.

Bitcoin price forecasts and volatility

Analysts project various scenarios for post-2028 price action. Stock-to-flow models suggest prices could reach $500,000-$1 million. These models assume historical halving impacts continue despite Bitcoin’s growing market cap.

More conservative estimates factor in diminishing returns with each halving. A 5x increase from pre-halving prices would still represent significant appreciation. Market maturity and institutional involvement may dampen extreme volatility.

External factors increasingly influence Bitcoin’s price trajectory. Regulatory developments, macroeconomic conditions, and competing technologies all affect demand. The Bitcoin halve provides a supply catalyst but doesn’t guarantee specific price outcomes.

How Halving Affects Other Proof-of-Work Coins

Litecoin, Dogecoin, and other PoW halvings

Litecoin implements similar halving mechanics with its own four-year cycle. The most recent Litecoin halving in August 2023 reduced rewards from 12.5 to 6.25 LTC. Price appreciation proved more muted compared to Bitcoin halvings.

Dogecoin follows a different model with fixed annual issuance of 5 billion coins. This creates perpetual inflation rather than Bitcoin’s deflationary schedule. Other PoW coins like Bitcoin Cash and Zcash mirror Bitcoin’s halving timeline.

Market size and liquidity dramatically impact halving effects. Smaller PoW coins experience more volatile price swings but less sustained appreciation. Mining economics become precarious faster for coins with lower market values.

Correlation between Bitcoin halving and altcoin performance

Bitcoin halvings historically trigger broader crypto market rallies. Capital rotates from Bitcoin to altcoins as investors seek higher returns. This “altseason” phenomenon typically occurs 6-12 months post-Bitcoin halving.

Ethereum, despite transitioning to Proof-of-Stake, still correlates with Bitcoin halving cycles. DeFi tokens and layer-2 solutions often outperform during these periods. The rising tide of Bitcoin appreciation lifts most crypto assets.

Smart investors position in quality altcoins before Bitcoin halvings. Historical data shows 10-50x returns possible for well-chosen alternatives. Risk management remains crucial as many altcoins fail to sustain post-halving gains.

Mining Profitability After Halving

Cost of production vs. market price

Mining profitability depends on three key variables: hardware efficiency, electricity costs, and Bitcoin price. Current generation ASIC miners achieve 30-40 J/TH efficiency. At $0.05/kWh electricity, breakeven occurs around $30,000-35,000 per Bitcoin.

Post-2028 halving doubles the breakeven price if other variables remain constant. Miners must either secure cheaper electricity, upgrade to more efficient hardware, or hope for price appreciation. Many operations won’t survive without adapting.

Geographic advantages become more pronounced after halvings. Miners in regions with $0.02-0.03/kWh electricity maintain healthy margins. Those paying residential rates face immediate unprofitability when rewards halve.

Survival of efficient miners

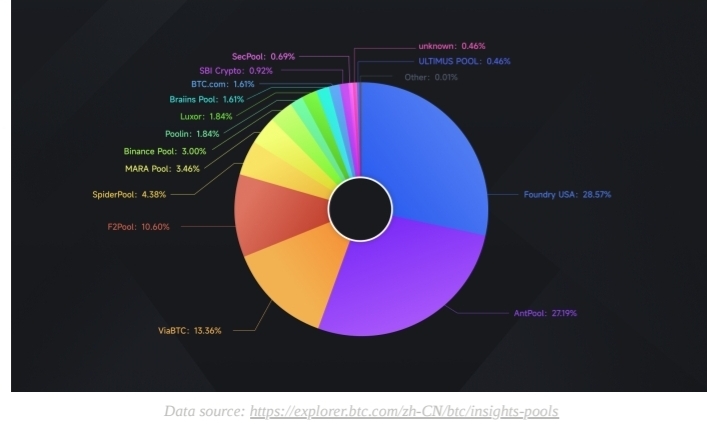

Industrial-scale operations dominate post-halving landscapes. Publicly traded miners like Marathon and Riot platforms control increasing network percentages. Their access to capital markets enables continuous hardware upgrades.

Renewable energy integration provides sustainable competitive advantages. Hydro, solar, and wind power offer stable, low-cost electricity. Miners co-locating with renewable projects secure long-term viability.

Heat recycling and grid balancing create additional revenue streams. Progressive miners sell excess heat for agriculture or district heating. Grid operators pay miners to consume excess electricity during peak generation periods.

Cloud mining and contract risks post-halving

Cloud mining contracts face severe stress during halvings. Most contracts become unprofitable when rewards halve unless Bitcoin price doubles. Providers often include clauses allowing contract termination below profitability thresholds.

Investors must scrutinize maintenance fees and contract terms carefully. Hidden fees consume larger percentages of reduced mining rewards. Many cloud mining operations shut down entirely following halvings.

Direct mining investment proves more sustainable than cloud contracts. Owning hardware provides flexibility to relocate or upgrade. Cloud mining customers remain locked into unfavorable terms as market conditions change.

Broader Economic and Network Effects

Network security and hash rate stability

Temporary hash rate drops following halvings raise security concerns. A 25% hash rate decline reduces attack costs proportionally. However, Bitcoin’s massive network makes 51% attacks economically unfeasible even during transitions.

Difficulty adjustments restore equilibrium within weeks. The network self-regulates to maintain consistent block times. Historical halvings proved Bitcoin’s resilience against significant hash rate fluctuations.

Long-term security relies on transaction fee growth. As block subsidies approach zero, fees must incentivize sufficient mining power. Lightning Network and other scaling solutions complicate this transition.

Long-term inflation rate and scarcity model

Bitcoin’s inflation rate drops below gold’s approximately 1.5% annual supply growth after 2024. The 2028 halving pushes inflation near 0.45%, creating unprecedented monetary hardness. No major currency maintains such low supply growth.

Stock-to-flow ratios reach extreme levels post-2028. Bitcoin’s S2F exceeds 100, surpassing gold’s historical 50-60 range. This scarcity drives narrative shifts toward Bitcoin as “digital gold.”

The path to 21 million bitcoins becomes increasingly slow. Final bitcoins won’t be mined until approximately 2140. Each bitcoin halve marks a milestone toward absolute scarcity.

Predictions and Expert Opinions

Analyst forecasts for post-halving performance

Leading analysts project varied outcomes for 2028-2029. PlanB’s stock-to-flow model suggests $1 million Bitcoin by 2030. More conservative estimates from JPMorgan target $150,000-200,000 ranges.

On-chain analysts focus on accumulation patterns and long-term holder behavior. Glassnode data indicates strong hands accumulating before halvings. This supply squeeze amplifies halving impacts.

Macro factors weigh heavily in modern predictions. Central bank policies, inflation rates, and geopolitical tensions influence Bitcoin demand. The halving provides a catalyst but not sole price determinant.

Lessons from 2020 halving and 2021 bull market

The 2020 halving coincided with unprecedented monetary expansion. Federal Reserve money printing and zero interest rates created perfect conditions. Bitcoin’s fixed supply contrasted starkly with expanding fiat supplies.

Institutional adoption accelerated post-2020 halving. Tesla, MicroStrategy, and El Salvador made headlines with Bitcoin purchases. This legitimacy boost amplified traditional halving effects.

The 2021 peak at $69,000 represented a 7.8x increase from halving day. However, the subsequent 75% drawdown reminded investors about Bitcoin’s volatility. Timing entries and exits remains challenging despite predictable supply changes.

Scenarios: bull run, sideways movement, or miner capitulation

Bull case scenarios envision continued institutional adoption coinciding with supply shock. Bitcoin ETF flows could absorb entire new supply post-halving. Price discovery in six-figure territory becomes possible.

Sideways scenarios acknowledge market maturity and diminishing halving impacts. Bitcoin might trade in broad ranges as volatility decreases. This consolidation would disappoint moonshot expectations but indicate healthy development.

Miner capitulation represents the bear case. If Bitcoin prices stagnate while mining costs double, massive shutdowns could occur. This negative spiral historically creates buying opportunities for long-term investors.

How to Prepare for the Next Halving

For miners

Optimize operations years before the halving arrives. Upgrade to latest generation ASICs achieving sub-30 J/TH efficiency. Current S19 XP models won’t remain competitive post-2028.

Secure long-term electricity contracts below $0.04/kWh. Partner with renewable energy projects for sustainable rates. Consider geographic relocation to mining-friendly jurisdictions.

Diversify revenue streams beyond pure mining. Offer hosting services, develop heating applications, or participate in grid balancing. Multiple income sources provide halving resilience.

For investors

Dollar-cost averaging reduces timing risk around volatile halving periods. Begin accumulation 18-24 months before expected halving dates. This strategy captures pre-halving appreciation while avoiding FOMO peaks.

Monitor on-chain metrics for accumulation signals. Exchange outflows, long-term holder supply, and miner distribution provide insights. These indicators often front-run price movements.

Prepare for post-halving volatility in both directions. Set clear profit targets and stop losses. Historical 80% drawdowns can occur even in bull markets. Position sizing remains crucial for survival.

Conclusion

Bitcoin halvings represent cryptocurrency’s most predictable yet impactful events. The 2028 halving will reduce daily Bitcoin issuance to just 450 coins, pushing inflation below 0.5% annually. This systematic supply reduction forces profound changes across mining operations, market dynamics, and investor strategies.

Therefore, mining consolidation will accelerate as only the most efficient operations survive. Industrial-scale miners with renewable energy access dominate future hash rate distribution. Smaller miners must innovate or exit as margins compress.

The broader implications extend beyond Bitcoin to all Proof-of-Work cryptocurrencies. Each halve tests the sustainability of blockchain security models. Success requires balancing miner incentives, network security, and token value appreciation.

Sustainable mining practices and operational efficiency define the post-halving era. Winners prepare years in advance through strategic positioning. The countdown to 2028 has already begun for forward-thinking participants.

FAQ Section

What happens when Bitcoin halves? Bitcoin halving mining rewards by 50%, reducing new Bitcoin creation from 3.125 to 1.5625 BTC per block in 2028. This programmed supply reduction occurs every 210,000 blocks.

How will halve affect miners? Miners face immediate 50% revenue reduction unless Bitcoin price doubles. Inefficient operations shut down while low-cost producers gain market share. Only miners with electricity below $0.05/kWh typically survive.

Does Bitcoin halving always increase price? Historical halvings preceded significant price appreciation, but past performance doesn’t guarantee future results. The 2024 halving showed mixed results with initial price decline before later recovery.

When is the next Bitcoin halving? The next time for Bitcoin to halve is expected around April 2028, though exact dates depend on block production speed. Monitor block height approaching 1,050,000 for precise timing.

Do other coins have halving events like Bitcoin? Yes, many Proof-of-Work coins implement similar halve schedules. Litecoin, Bitcoin Cash, and Zcash follow comparable four-year cycles with 50% reward reductions.