Pocket Option Review: An In-Depth Look at This Innovative Binary Options Broker In recent...

Forex Trading

Forex Trading For Beginners

Binary Options Brokers For Beginners: The Top 10 Binary Options Brokers for 2024 Binary...

How To Trade Binary Options: Beginners guide to successful trading. Binary options have grown...

How to login to meta trader 4 on Android complete with pictures. Welcome to...

Etoro is a leading social trading and multi-asset investment platform that has revolutionized the...

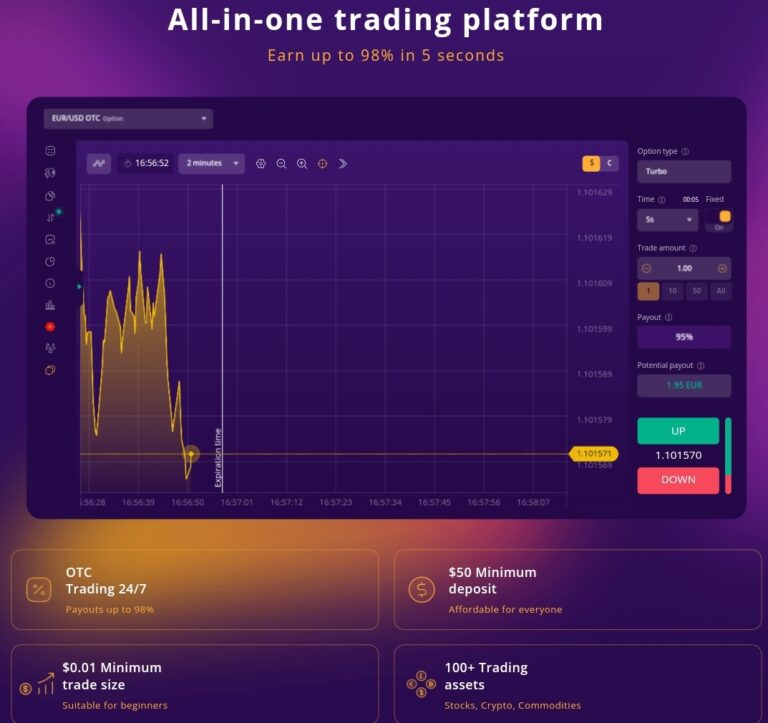

Iqcent Review: In the fast-paced world of online trading, finding a reliable and user-friendly...

Best Forex Brokers In 2024, best forex brokers for beginners, best forex brokers in...

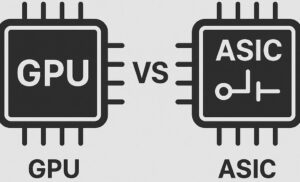

803 mine pool bitcoin mining review. 803 mine pool review for shortcomings. And the...